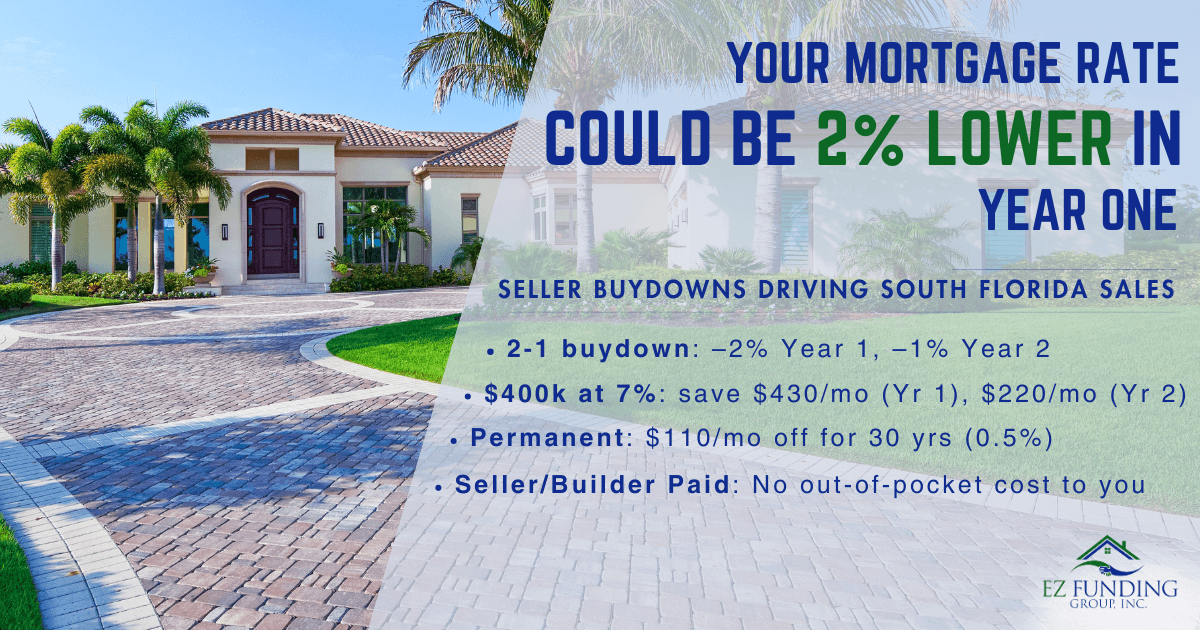

Miami-Dade Buyers: Your Mortgage Rate Could Be 2% Lower in Year One. Here's the Secret Strategy Sellers Are Using Right Now. | EZ Funding Group, Inc.

Discover how rate buydowns cut mortgage payments by $400+/month in Weston and Broward. Learn the seller-paid strategy from South Florida mortgage broker EZ Funding Group, Inc.

Rate buydowns are quietly reshaping affordability for South Florida homebuyers, and right now, sellers in Weston, Miramar, and Pembroke Pines are offering deals that can cut your first-year mortgage payment by more than $400 per month.

If you've been house hunting in Broward County, Miami-Dade, or Palm Beach lately, you may have noticed something new popping up on listing sheets and builder incentives: "2-1 buydown available" or "seller will pay for permanent rate reduction." These sound like marketing gimmicks, but they're actually powerful financing strategies that can make homeownership significantly more affordable in today's higher-rate environment.

At EZ Funding Group, we're seeing more sellers in Pembroke Pines, Hollywood, and Coral Springs use these tools to attract serious buyers. Savvy first-time homebuyers in Florida are taking full advantage, and we want to make sure you understand exactly how these work and what they mean for your monthly budget.

What Is a Rate Buydown?

A rate buydown happens when the seller or builder pays an upfront fee to temporarily or permanently lower your mortgage interest rate. Think of it as a gift that reduces your monthly payment: sometimes by hundreds of dollars without you paying anything extra out of pocket.

There are two main types you'll see in South Florida real estate today:

Temporary Buydowns: The 2-1 and 1-0 Programs

2-1 Buydown: Your interest rate drops by 2% in year one, 1% in year two, then returns to the full note rate in year three and beyond.

Real Weston Example: Let's say you're financing a $400,000 home with a 7% interest rate. With a 2-1 buydown:

Year 1: Your rate is 5%, saving you approximately $430 per month

Year 2: Your rate is 6%, saving you approximately $220 per month

Year 3+: Your rate returns to the full 7%

Over the first two years, that's more than $7,800 in savings. Doesn’t that sound like money you can instead use for furniture, home improvements, or simply breathing room as you settle into your new Broward home?

1-0 Buydown: Your rate is reduced by 1% in the first year only, then returns to the full rate in year two.

Example: On that same $400,000 loan at 7%, a 1-0 buydown drops your year-one rate to 6%, saving you around $220 per month or over $2,600 in the first year alone.

Permanent Buydowns: Long-Term Savings

With a permanent buydown, the seller pays upfront discount points to lower your interest rate for the entire life of your loan. If a seller in Miramar offers to buy down your rate by 0.5% permanently, that $400,000 loan at 7% becomes 6.5%, saving you approximately $110 per month for 30 years. That's nearly $40,000 in total interest savings!

Why Are Sellers Offering This Across South Florida?

In competitive markets like Miramar, Pembroke Pines, and Miami-Dade, sellers and builders know that today's buyers are rate-sensitive. By offering a buydown, they make their listing stand out without dropping the sale price. For you, it's a win-win: immediate payment relief and the seller moves their property faster.

Just last week, we helped a young couple in Pembroke Pines close on a townhouse where the builder offered a 2-1 buydown. Their first-year payment dropped by over $400 per month, giving them the financial cushion they needed to confidently move forward with their first home purchase.

How to Take Advantage of Rate Buydowns in Your Home Search

Ask your real estate agent to look for listings advertising buydown incentives, or negotiate a seller-paid buydown into your offer.

Get pre-approved early at EZ Funding Group, Inc. so you know your baseline rate and can accurately calculate potential savings.

Work with a local South Florida mortgage broker who understands how to structure and qualify these deals correctly; not all lenders handle buydowns the same way.

Compare buydowns to other incentives like closing cost credits. Sometimes a strategic combination makes the most sense for your situation.

Ready to See How Much You Could Save?

If you're thinking about buying or refinancing in South Florida, now is the time to explore every tool available to make your monthly payment more manageable. Rate buydowns are just one of many strategies we use at EZ Funding Group, Inc. to help Broward home loan applicants maximize affordability.

Ready to find out how much you could save on a home in Weston, Miramar, Pembroke Pines, or anywhere in Broward County? Click here to start your pre-approval or schedule a quick 15-minute call to discuss your options. Let's find the right buydown strategy for your next home.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender