Recent Articles

Is Refinancing Your Mortgage the Right Move?

Find out if refinancing is right for you.

Housing Affordability in 2026: Why Rates Are not the Only Factor

Learn about home affordability factors with examples nationwide.

Shorter Inspections Without Waiving Protection

In 2026, a shorter inspection period can make your offer feel "cleaner" to a seller, especially in Broward, Miami-Dade, and Palm Beach. But "short" should never mean "blind" and sellers can tell the difference. The goal is a faster, better-managed inspection that reduces seller uncertainty while protecting you from expensive surprises.

Clean Offers Explained: What Sellers Actually Want in 2026

In 2026, a “clean offer” does not mean giving up all protections. It means reducing uncertainty for the seller so the deal feels easy to accept and likely to close. In Broward, Miami-Dade, and Palm Beach, sellers are not just comparing price. They are comparing risk.

Pre-Qualified vs Pre-Approved: Why It Matters in Competitive Markets

In competitive South Florida markets, the words on your letter can decide whether a seller takes your offer seriously. The difference between pre-qualified and pre-approved is not just semantics. It is the difference between "this might work" and "this is likely to close."

How to Strengthen a Financed Offer to Compete With Cash

Sellers choose cash because they've seen financed deals fall apart late. A cash offer feels "strong" because it feels certain. To compete as a financed buyer in South Florida, you do not need to be reckless. You need to be prepared, documented, and easy to close. In Broward, Miami-Dade, and Palm Beach, sellers often choose the offer that reduces delays and renegotiations, even if it is not the highest number.

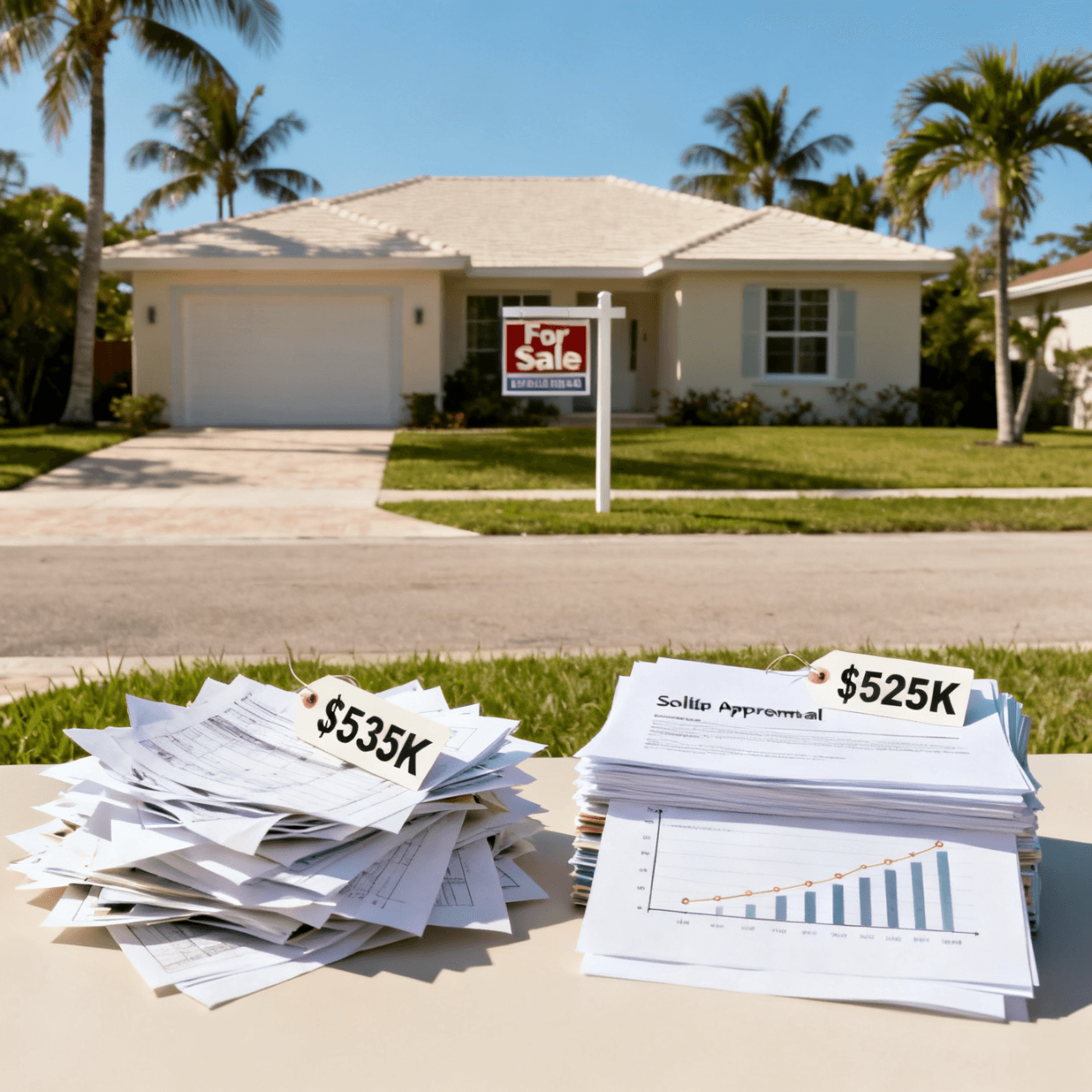

Multiple Offers in South Florida: Why the Highest Price Doesn't Always Win

In South Florida, the "winning" offer is often the one that feels the most certain, not just the one with the biggest number. Sellers and listing agents are managing risk: delays, re-trades, appraisal issues, and financing fallout because they need the deal to close on time without surprises. A slightly lower price can bea

How to Protect Your Deal When a Home Needs Insurance Repairs

When Florida insurance underwriting requires repairs, delayed closing is the real risk, but it's fixable with speed and structure. If insurance flags roof, electrical, plumbing, HVAC, or water intrusion issues, your goal is to keep the home "bindable" fast without turning your contract into a stressful renegotiation. In Broward, Miami-Dade, and Palm Beach, this happens often, and buyers who plan ahead close on time.

What Happens If Insurance Can't Be Bound Before Closing

In Florida, if homeowners insurance cannot be bound (issued and active with the correct binder/declarations), the lender typically cannot close the loan. Even if the borrower is fully approved, insurance is a funding requirement. When binding fails, closings most often get delayed, sometimes get renegotiated, and in worst-case scenarios, the deal can fall apart.