Recent Articles

How Insurance Requirements Can Change After Inspection

In Florida, insurance requirements can change after inspection because underwriting is not complete until the carrier reviews the property's actual condition through inspection reports. In 2026, many buyers in Broward, Miami-Dade, and Palm Beach discover new requirements after inspection underwriting review such as roof documentation, repairs, higher deductibles, or even carrier declines. This can delay closing even when the mortgage is otherwise approved. Buyers who send inspection reports immediately and plan for underwriting conditions protect their closing timeline.

Credits vs. Repairs: What Works Better in Florida Negotiations

In Florida negotiations, credits often work better for speed and control, while repairs work better when the issue is safety-related, insurability-related, or lender-required. In 2026, the "best" choice usually comes down to one question: Does this issue need to be fixed to close on time and get insurance bound? If yes, repairs (or proof of repairs) often win. If not, a credit is usually cleaner. This distinction matters more in Florida than most states due to insurance binding rules, lender conditions, and tight post-contract timelines.

How Florida Buyers Lose Deals During Inspection (Even With Fair Requests) 2026 Guide

Many Florida buyers lose deals during inspection in 2026 not because the request is unreasonable, but because the delivery is. The inspection response can come off as a threat, a remodel wish list, or a moving target. Sellers (and listing agents) often react to certainty risk: "Is this buyer going to keep coming back for more?" If you keep your request short, evidence-based, and insurer-focused, you can protect your budget without triggering a seller to dig in, counter hard, or walk.

Why Florida Insurance Delays Closings More Than Financing in 2026

In 2026, many Florida transactions do not fall apart because a buyer cannot qualify. They slow down because insurance cannot be finalized fast enough. A lender can approve a file, but the loan cannot close until the home is insurable, the policy is bound, and the lender receives the correct binder/declarations page. In Broward, Miami-Dade, and Palm Beach, stricter underwriting (roof age, inspection requirements, claims history, and condo/HOA complexities) has turned insurance into a timeline item that can delay closings more than financing. In many South Florida deals, buyers are fully loan-approved while insurance is still pending inspections, roof verification, or carrier approval days before closing.

Roof Age in Florida: When It Affects Insurance, Loans, and Value

In 2026, roof age is not just a maintenance detail in Florida. It can be an insurance approval issue, a mortgage-closing timeline issue, and a value/negotiation issue. Many deals in Broward, Miami-Dade, and Palm Beach slow down when roof documentation is missing, the roof is near end-of-life, or a 4-point inspection triggers insurance conditions. The safest move is to treat roof age like a financing and insurance filter before you fall in love with a property.

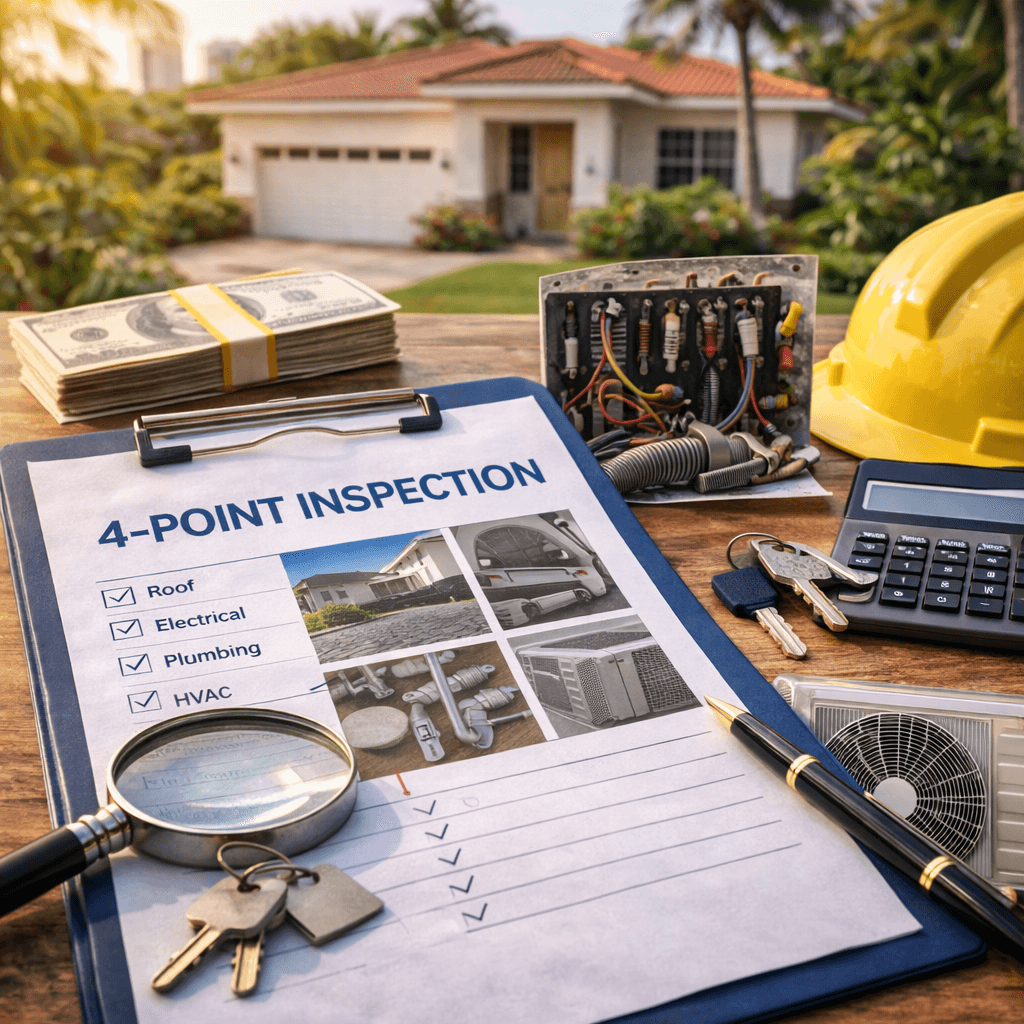

What Inspection Items Matter Most to Lenders and Insurers

In 2026, lenders and insurers care less about cosmetic defects and more about insurability, safety, and big-system risk. The inspection items most likely to impact your mortgage approval or insurance ability in Florida are roof condition, water intrusion, electrical hazards, plumbing failures, HVAC condition, and property issues that trigger insurance underwriting. These items can delay closing, raise your monthly payment through higher premiums, or make a property hard to finance at all.

Inspection Negotiations in 2026: What Florida Buyers Can Reasonably Ask For

In 2026, the strongest Florida inspection negotiations are short, safety-first, and evidence-based. Buyers should focus requests on major systems, active leaks, safety hazards, and insurability issues, not cosmetic upgrades (like paint or fixtures). The goal is not to "win" the inspection. The goal is to reduce risk, protect your budget, and keep the deal realistic in Broward, Miami-Dade, and Palm Beach.

Insurance Shopping Timeline: When to Start So It Doesn't Delay Closing (2026)

In 2026, Florida buyers should start insurance planning before writing an offer and secure quotes within 48 hours of going under contract. Insurance is one of the most common closing delays in Broward, Miami-Dade, and Palm Beach not because buyers forget about it, but because they start too late. Underwriting requires inspections, roof documentation, and carrier approval, all of which take time. A clear timeline protects your closing date and your loan approval.

Insurance Shock? How Florida Buyers Can Plan Smarter in 2026

Insurance "shock" happens when Florida buyers treat coverage as a closing-week task instead of a home-selection filter. Picture this: you're approved, your offer is accepted, then the insurance quote arrives and your monthly payment jumps by $300. Suddenly, the home you could afford feels out of reach. In 2026, the smartest buyers in Broward, Miami-Dade, and Palm Beach get quote scenarios early, understand what makes a home insurable (or expensive to insure), and budget for the real monthly payment, not just the list price. Planning ahead turns insurance from a panic into a strategy.