Recent Articles

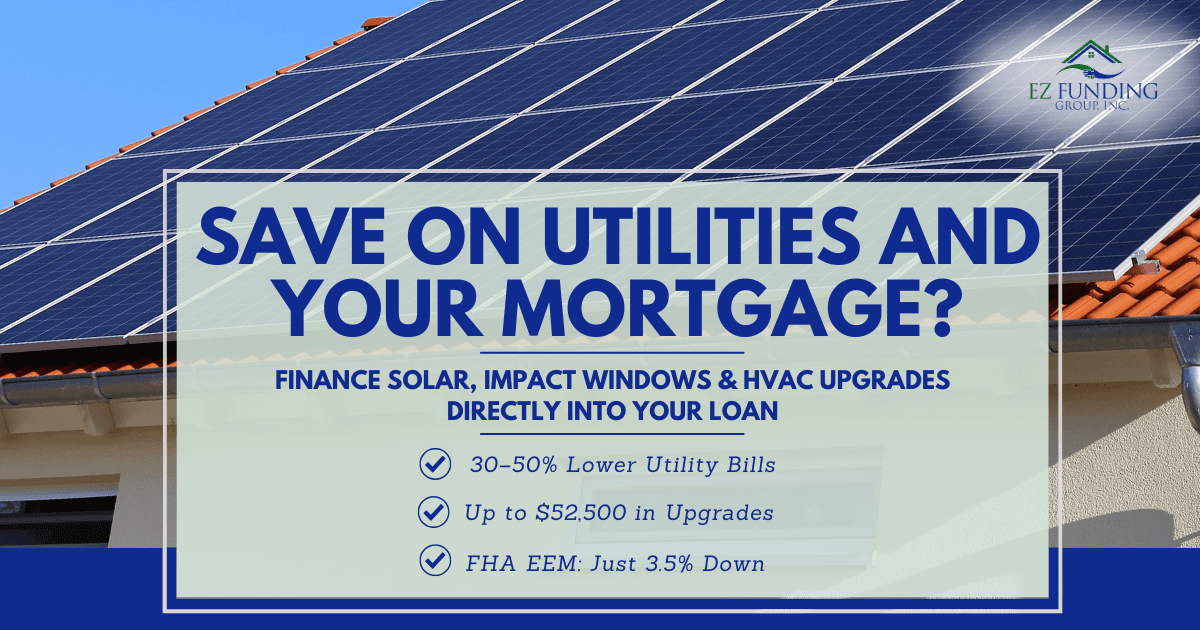

Want a Lower Utility Bill and a Better Mortgage? Explore Energy-Efficient Loans in Florida.

Discover how green mortgages and energy-efficient loans can help South Florida homebuyers save on utilities while financing eco-friendly upgrades. Learn about FHA Energy Efficient Mortgages and Fannie Mae HomeStyle Energy programs in Broward, Miami-Dade, and Palm Beach counties.

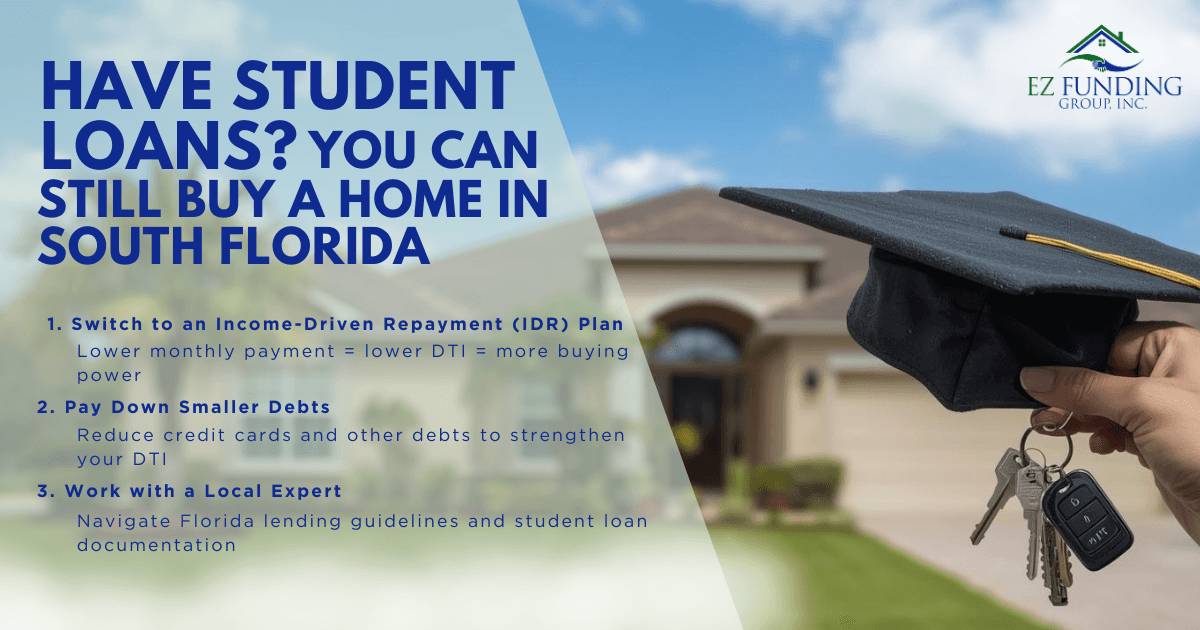

Have Student Loans? You Can Still Buy a Home in South Florida. Here's How to Qualify for a Mortgage in Miami-Dade, Broward & Palm Beach Counties.

Student loans and homeownership in South Florida? It’s possible! Learn how income-driven repayment plans and debt-to-income strategies help you qualify for a mortgage in Broward, Miami-Dade, Palm Beach, and beyond.

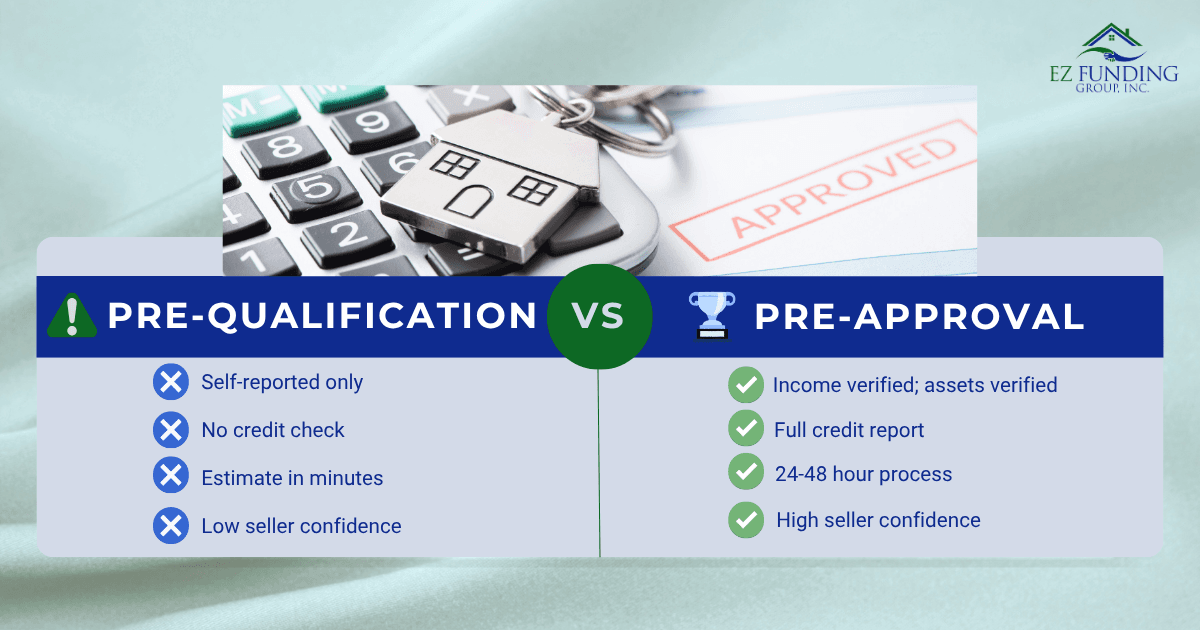

Pre-Qualified or Pre-Approved? The Difference Could Cost You a Home in South Florida | EZ Funding Group, Inc.

Pre-qualified vs. pre-approved: Why verified pre-approval wins offers in competitive Florida markets. Get pre-approved in 24-48 hours with EZ Funding Group, Inc.

Florida Condo Financing: Your 2025 Guide to SB 154, SIRS & Mortgage Approval | EZ Funding Group, Inc.

Learn how Florida's SB 154 condo laws impact your mortgage approval. Get our checklist for SIRS compliance, reserve requirements, and what lenders require for Hollywood, Aventura, Sunny Isles Beach high‑rises, Downtown Fort Lauderdale towers, Coral Gables condos, and South Florida markets.

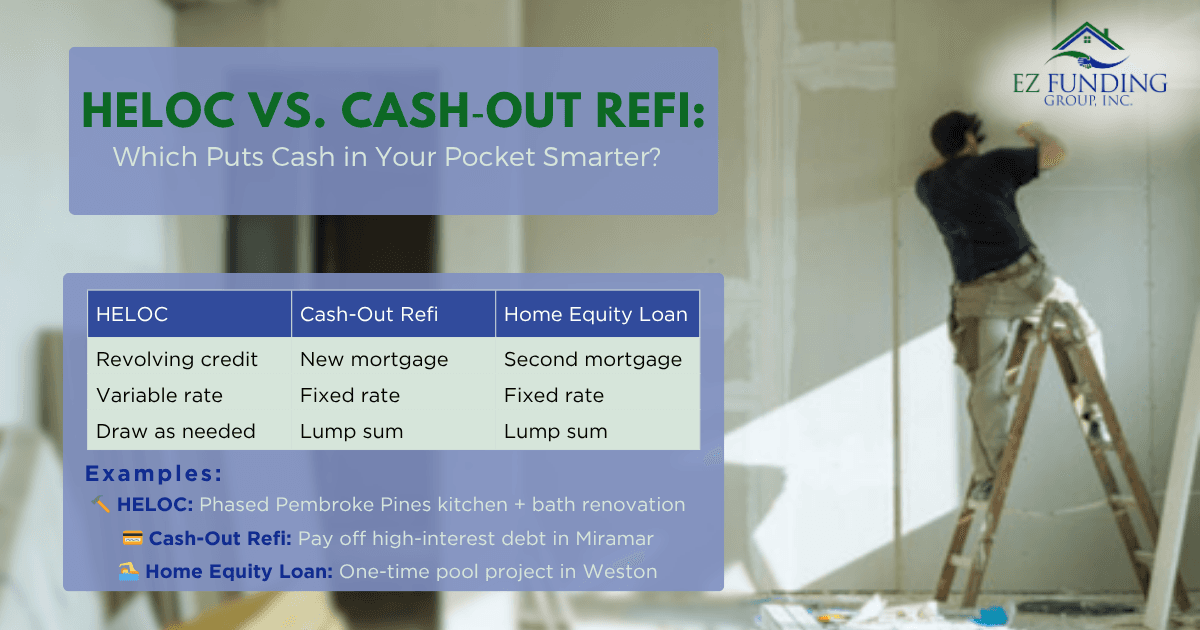

HELOC vs. Cash‑Out Refinance in Florida: Which Is Better for Renovations and Debt Consolidation? | EZ Funding Group, Inc.

Jacksonville, Orlando, Tampa & Miami homeowners: discover when to use a HELOC vs. cash-out refinance for renovations, debt consolidation, and home equity access.

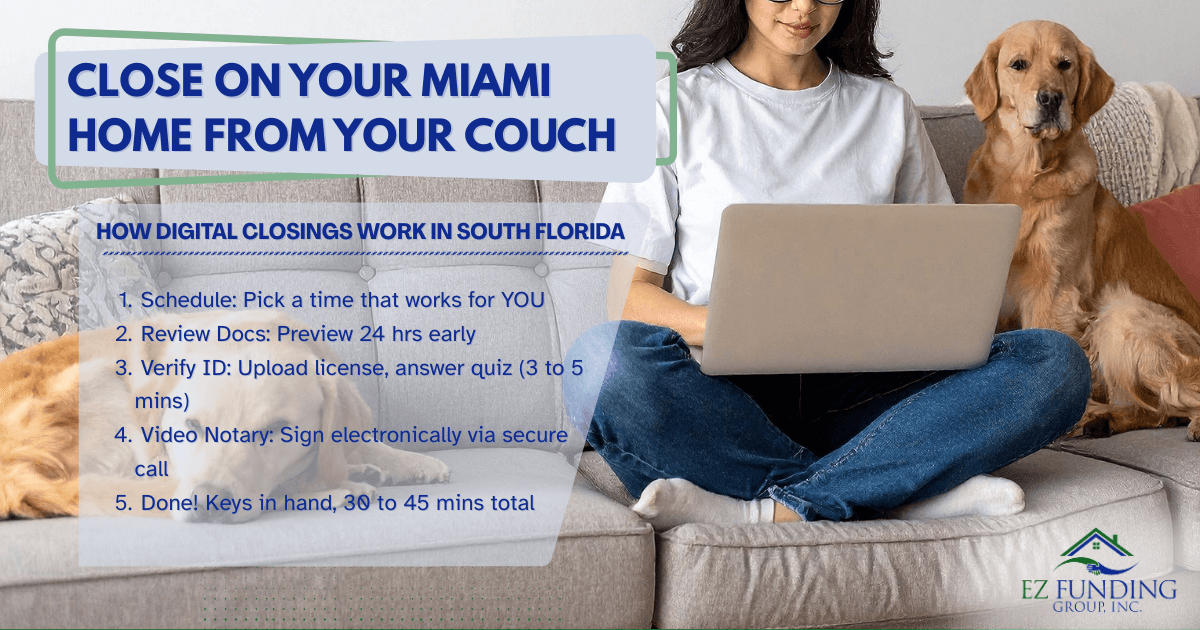

You Can Now Close on Your Miami Home from Your Couch. Here's How. | EZ Funding Group, Inc.

Miami & South Florida buyers: discover how remote online notarization (RON) and eClosings make buying a home faster, easier, and more convenient.

Miramar & Pembroke Pines Buyers: Should You Tap Your 401(k) for a Down Payment? 3 Risks You Must Know | EZ Funding Group, Inc.

Miramar & Broward buyers: learn 3 critical risks of using 401(k) loans or SBLOC for down payments, plus safer alternatives like FHA 3.5% down.

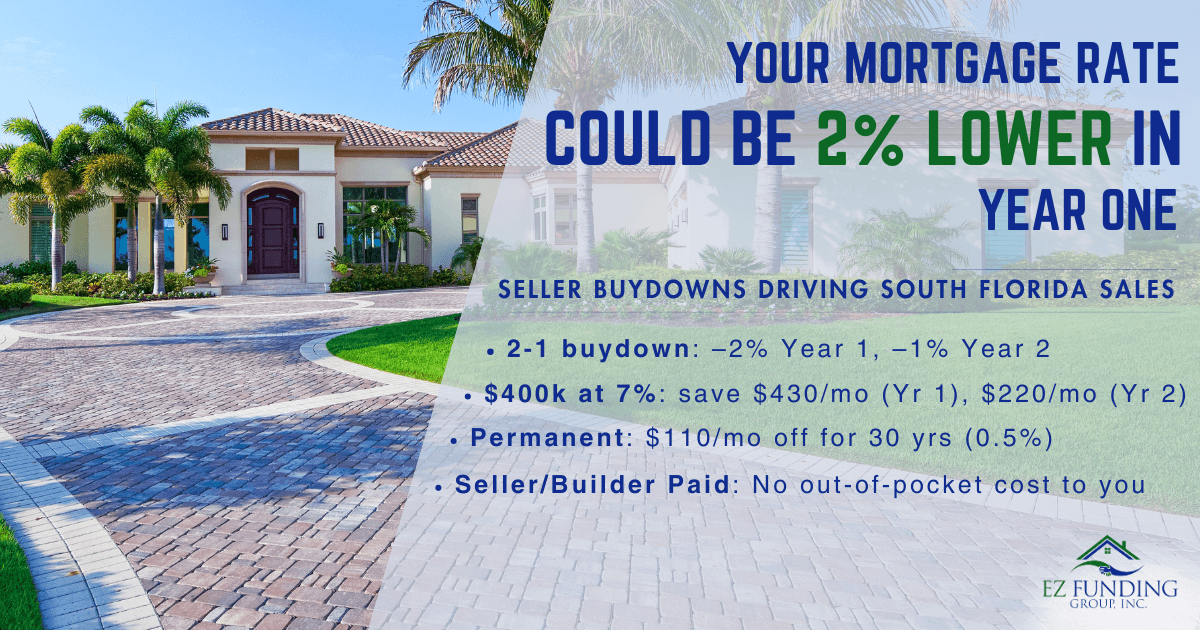

Miami-Dade Buyers: Your Mortgage Rate Could Be 2% Lower in Year One. Here's the Secret Strategy Sellers Are Using Right Now. | EZ Funding Group, Inc.

Discover how rate buydowns cut mortgage payments by $400+/month in Weston and Broward. Learn the seller-paid strategy from South Florida mortgage broker EZ Funding Group, Inc.

Self-Employed in Broward? Here's How Gift Funds and Non-QM Loans Help You Buy a Home Faster| EZ Funding Group, Inc.

South Florida buyers in Miramar, Pembroke Pines, and Weston can accelerate their path to homeownership. Gift funds and Non-QM loan programs make it possible to qualify faster, even without traditional W-2 income or a large down payment saved.