Recent Articles

Rates Just Hit a 10-Month Low!

Mortgage rates just hit their lowest levels since October 2024 following a big shift in the bond market. Here’s why it matters for homebuyers and homeowners.

Housing Market Confusing? Here’s Why You’re Hearing Mixed Messages

Confused by the housing market? You're not alone. Here's why the market feels hot and cold at the same time—and what it means for you as a homebuyer.

Could Removing Capital Gains Taxes on Home Sales Revive the Housing Market?

A new proposal suggests removing capital gains taxes on primary home sales to boost the housing market. Here’s what it could mean for homeowners and buyers.

Game-Changer: Credit Scores Just Got Rewritten

A new credit scoring update could impact who qualifies for a mortgage and at what rate. Learn what this means for first-time buyers and why now is the time to speak with your loan officer.

Should You Buy a Home Before Your Divorce is Final? Here’s What to Know

Buying a house before your divorce is finalized? Here’s why it could create legal and financial complications—and how to plan smart.

Why Homeownership Is Still Worth It—Even Beyond the Finances

From mental health benefits to stronger communities, homeownership offers more than just a return on investment—it offers a better quality of life.

Mortgage Rates Aren’t Just About the Fed — Here’s What You Really Need to Know

Mortgage rates held steady this week—but not for the reasons you think. Here’s why working with a loan officer beats doing your own research when timing the market.

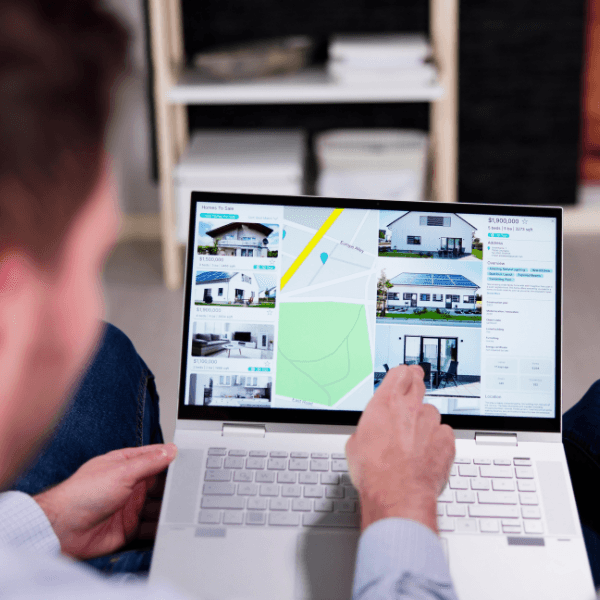

The Real Estate Rule That Just Got Repealed—And Why It’s a Big Win for Buyers

The National Association of Realtors repealed a rule that kept some listings hidden—thanks in part to pressure from homebuyers, tech platforms, and even the DOJ. Learn how this boosts your home search.

Why Now Might Be the Best Time in Years to Buy a Home (Seriously)

The housing market is shifting—and it's shifting in your favor. Learn why rising inventory, slower sales, and increased negotiating power mean buyers have the upper hand. Don’t miss your window.