Want a Lower Utility Bill and a Better Mortgage? Explore Energy-Efficient Loans in Florida.

Discover how green mortgages and energy-efficient loans can help South Florida homebuyers save on utilities while financing eco-friendly upgrades. Learn about FHA Energy Efficient Mortgages and Fannie Mae HomeStyle Energy programs in Broward, Miami-Dade, and Palm Beach counties.

Imagine living in a home that’s cooler, cheaper to run, and qualifies for better financing, all at once. That’s the power of energy-efficient mortgages, and South Florida buyers now have more options than ever to finance eco-friendly upgrades directly into their home loan.

At EZ Funding Group, we help borrowers in Miramar (Silver Lakes, Monarch Lakes), Pembroke Pines (Chapel Trail, Pembroke Falls), Hollywood (Emerald Hills, Hollywood Lakes), Weston (Savanna, Weston Hills), and across Broward, Miami-Dade, and Palm Beach Counties leverage programs that reduce utility costs and improve overall loan affordability.

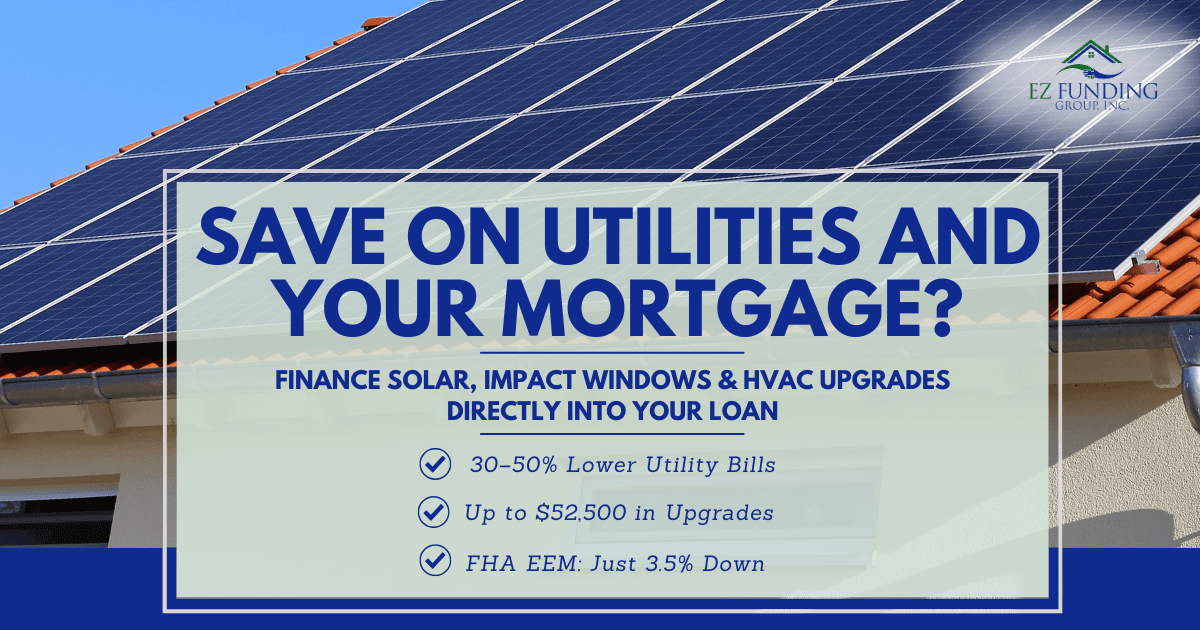

Whether you’re purchasing a high-efficiency new construction home or updating an older property with solar panels, insulation, impact windows, or a high-efficiency HVAC system, today’s green mortgage options make going green easier and more affordable.

What Is a Green Mortgage?

A green mortgage (or energy-efficient mortgage) allows buyers to roll approved energy-saving upgrades into their home loan when buying or refinancing. Because efficient homes cost less to operate, lenders recognize that homeowners typically have more monthly cash flow which can help with loan approval.

Florida buyers commonly use:

FHA Energy Efficient Mortgage (EEM)

Fannie Mae HomeStyle Energy

These programs are especially popular among first-time homebuyers working with a South Florida mortgage broker who understands how energy upgrades impact affordability.

How Energy Audits Work (and Why You Need One)

Most green mortgage programs require a Home Energy Rating System (HERS) audit or a similar certified energy report. Here’s what to expect:

A licensed energy auditor inspects the home’s insulation, ductwork, windows, HVAC, and appliances.

They identify upgrades that offer meaningful energy savings.

The audit calculates the cost-to-savings ratio, helping determine which improvements qualify.

The cost of the audit is often rolled into the mortgage.

Energy audits give buyers confidence and help lenders verify that improvements will deliver real financial benefits.

FHA Energy Efficient Mortgage (EEM): Save While You Buy

The FHA EEM is one of the most accessible green loan options for first-time Florida homebuyers. It allows qualified energy upgrades to be financed directly into your FHA loan, without requiring a higher down payment.

How it works:

After going under contract, a certified energy audit is completed.

The audit identifies cost-effective improvements like HVAC upgrades, insulation, smart thermostats, or solar water heaters.

Borrowers can finance up to 5% of the home’s value (or set FHA limits) toward approved improvements.

This is especially beneficial in cities like Weston, Hollywood, Coral Springs, and Pembroke Pines, where cooling costs can remain high for most of the year.

Fannie Mae HomeStyle Energy: Finance Upgrades with Your Purchase

For buyers using a conventional loan, Fannie Mae’s HomeStyle Energy program offers even greater flexibility. Borrowers can finance up to 15% of the home’s “as-completed” value for energy-efficient and resiliency improvements, including:

Solar panels

High-efficiency air conditioning

Energy Star appliances

Smart thermostats

Impact-resistant windows

Cool roofing

LED lighting and weatherization

Wind/hazard resiliency upgrades

Example:

Buying a $350,000 home in Miramar? With HomeStyle Energy, you could finance up to $52,500 for upgrades like solar panels, impact windows, additional insulation, or a high-efficiency HVAC system consolidated into one mortgage and one monthly payment.

FHA EEM vs. HomeStyle Energy: What’s the Difference?

Why Energy-Efficient Homes Make Sense in South Florida

In South Florida’s hot, hurricane-prone climate, green upgrades offer powerful advantages:

Lower utility bills — Many homeowners save 30–50% on cooling costs.

Higher resale value — Buyers increasingly prioritize eco-friendly features.

Storm protection + energy savings — Impact-resistant windows offer both.

Local incentives — Utilities in Broward, Miami-Dade, and Palm Beach offer rebates for qualifying upgrades.

Better climate comfort — More stable indoor temperatures mean less A/C usage.

For buyers exploring new construction in Parkland, Doral, Wellington, Weston, and Palm Beach Gardens, many builders already include efficiency features, making green mortgage programs even more attractive.

Who Benefits Most from Green Mortgage Programs?

These programs are ideal for:

First-time buyers seeking lower long-term costs

Buyers of older homes in Hollywood, Hialeah, Lake Worth, or Plantation

Homeowners adding solar or high-efficiency HVAC

Buyers needing impact windows or storm protection upgrades

Borrowers refinancing to reduce energy costs

If you’re purchasing in a neighborhood with older construction (Hollywood Lakes, Little Havana, Lake Osborne Estates), green financing can drastically improve comfort and monthly affordability.

Frequently Asked Questions

What upgrades qualify for a green mortgage?

Typically: solar panels, insulation, HVAC systems, Energy Star appliances, energy-efficient windows/doors, LED lighting, water heaters, weatherization, impact windows, and more, subject to an energy audit.

Do I need excellent credit for an FHA EEM?

No. FHA’s standard guidelines apply often as low as 580 with 3.5% down.

Can condos or townhomes qualify?

Yes. FHA EEMs apply to FHA-approved condo communities, and HomeStyle Energy may also apply to certain condos and multi-unit properties.

Ready to Explore Energy-Efficient Homeownership in South Florida?

Energy-efficient homes help you save money, stay comfortable year-round, and build long-term value while green mortgages help finance upgrades in a smart, affordable way.

See how much you could save:

Get pre-approved in minutes: Start your application now

Book a free consultation: Book a free consultation

Learn more about eco-friendly mortgage options: Explore Florida homebuyer programs

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender