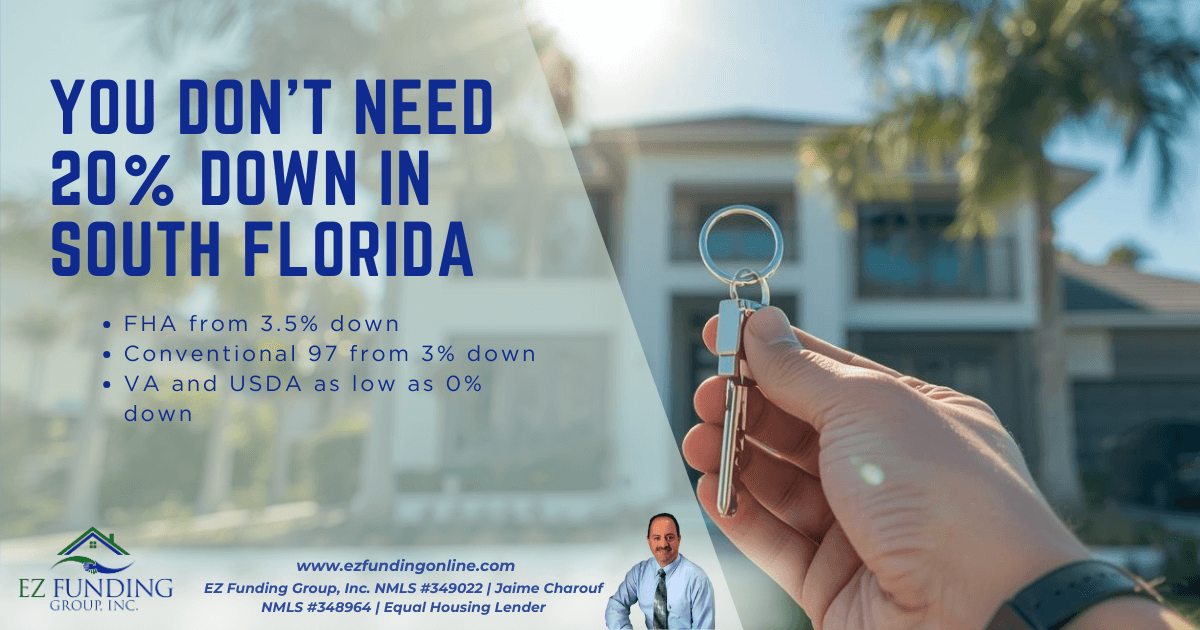

You Don't Need 20% Down to Buy a Home in South Florida | EZ Funding Group, Inc.

You don’t need 20% down to buy a home in South Florida. Discover FHA, VA, and 3% down programs that make homeownership easier with EZ Funding Group.

Buying a home in Miramar, Pembroke Pines, or anywhere in South Florida doesn’t have to mean saving for years — many buyers are getting approved with as little as 3% down.

If you’ve been dreaming of homeownership in South Florida but feel stuck by the idea of saving a 20% down payment, the good news is you often don’t need that much. At EZ Funding Group, we help first-time buyers and move‑up families across Broward, Miami‑Dade, and Palm Beach unlock flexible loan options with far less cash upfront.

Just last month, one of our clients in Tamarac bought a first home using 3.5% down through an FHA loan, paired with the Florida Hometown Heroes program. They were able to come in with about $6,900 out of pocket, something that once felt impossible.

Low-Down-Payment Programs Available in South Florida

FHA loans: 3.5% down

An FHA loan is a popular choice for first-time homebuyers in Florida. With just 3.5% down, it lowers the barrier to entry.

Perfect for: Buyers with limited savings or building credit

Local example: That 3.5% could open doors to a condo in Hollywood or a starter home in Pembroke Pines

VA home loans: 0% down

For eligible service members, veterans, and spouses.

Perfect for: Military buyers considering Weston or Miramar

Bonus: Competitive rates and no PMI in many cases

Conventional 97: 3% down

A great fit for buyers with solid credit who want conventional terms.

Perfect for: Those aiming to minimize upfront mortgage insurance

Local example: A townhouse in Coral Springs or a single‑family in Miami‑Dade

USDA Single Family Housing: 0% down

100% financing in eligible rural and some suburban areas.

Perfect for: Buyers exploring designated parts of Palm Beach County and beyond

Tip: Check eligibility for your target neighborhood

Learn more program details: FHA • VA • USDA • Broward County • City of Miami

Why the 20% Myth Persists

Putting 20% down can help avoid PMI, but waiting years to save that much can mean missing out on equity gains and today’s opportunities in the South Florida market.

How We Help

As your local Miramar mortgage team, we assess your full picture and match you with the down payment assistance or loan program that fits your goals, so you can buy with clarity and confidence.

Ready to find out how little you really need to buy your next home in South Florida? Click here to start your pre-approval or click here to schedule a quick meeting with us.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender