Recent Articles

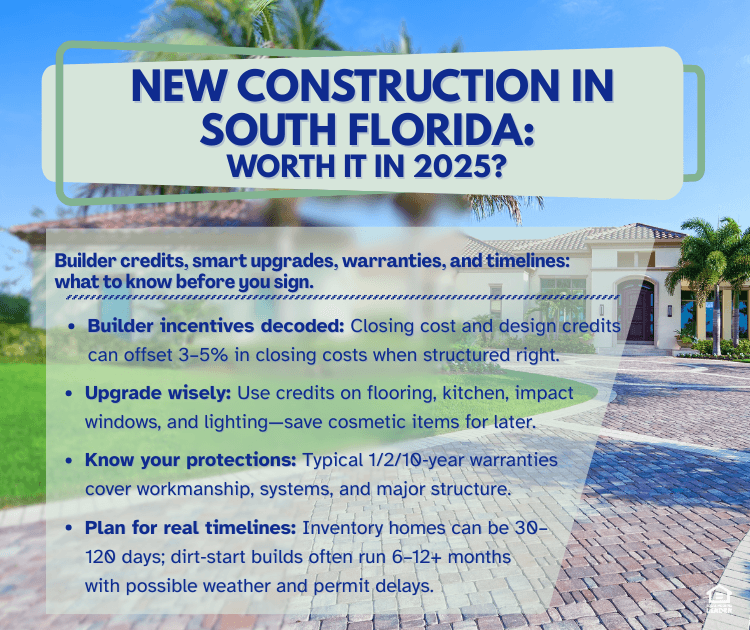

New Construction Homes in South Florida: What to Expect in 2025

Is new construction worth it in 2025? For buyers in Broward and Miami-Dade, the answer depends less on flashy ads and more on understanding builder incentives, smart upgrades, warranty coverage, realistic timelines, and total costs. When you know how South Florida builder incentives work and what delays construction, you can get more value without closing-day surprises.

This Week in Mortgage Rates: Buyers Are Back as Rates Hover in the Low 6s

Mortgage rates bounced around but stayed in a tight range near the low 6% area this week, while purchase applications hit their highest level since early 2023 and refinance demand more than doubled compared to last year. Here’s what that means if you’re thinking about buying or refinancing.

Top 5 Miami Neighborhoods for Young Buyers in 2025

Quick answer: For young professionals moving to Miami-Dade, the best neighborhoods balance walkability, nightlife, transit, commute, and cost. In 2025, Brickell, Wynwood, Coral Gables, Coconut Grove, and Doral stand out as the top choices for under‑40 buyers who want a strong social scene and a realistic daily routine.

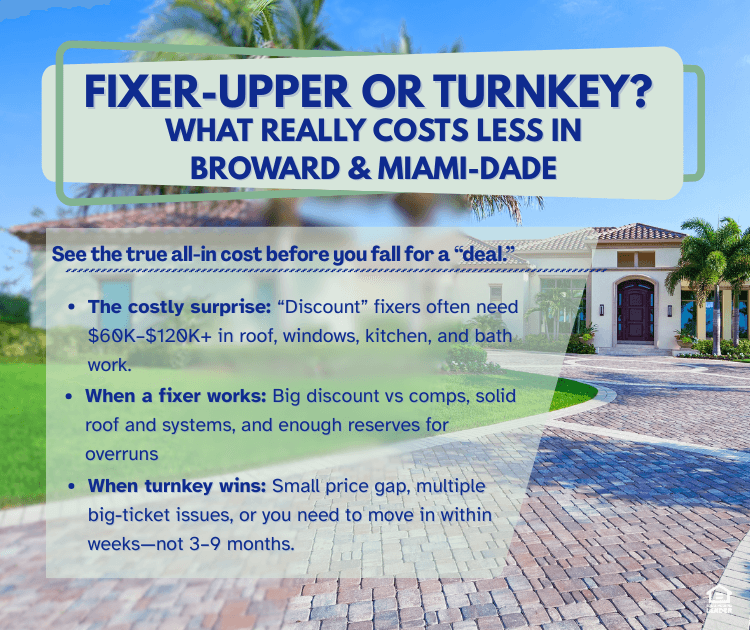

Fixer-Upper or Turnkey? What Really Costs Less in Broward & Miami-Dade

The costly mistake: Buyers in Broward and Miami-Dade often choose a fixer-upper because the list price is lower, then discover their "deal" costs $60,000–$120,000+ more than expected. That discounted home can end up more expensive than buying turnkey. This guide shows you the real all-in cost of both paths, so you can decide with confidence.

How to Protect Your Deal If Your Florida Home Appraises Low

Quick answer: When a Florida home appraises below your contract price, you're facing an appraisal gap. Your choices are to renegotiate the price, ask for seller credits, split the difference, adjust how much cash you bring in, or appeal the appraisal. The right move depends on your numbers, the strength of the appraisal, and how motivated both sides are to close.

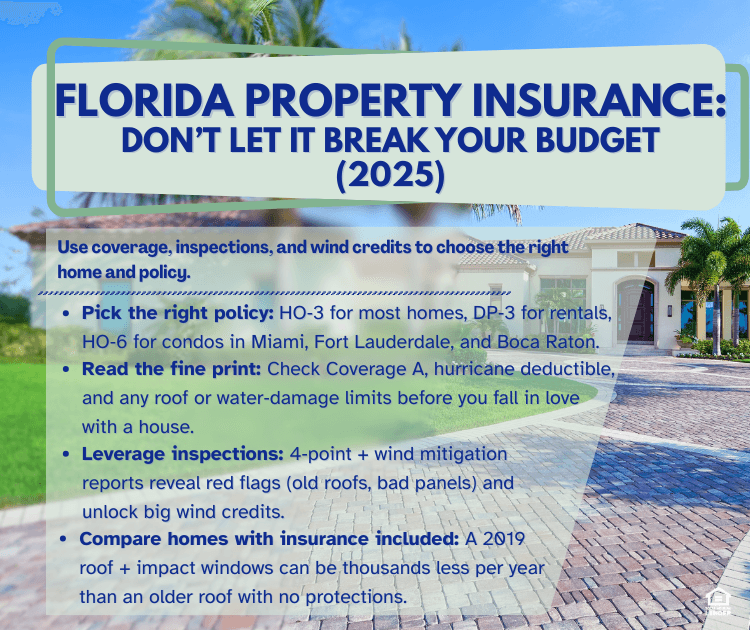

Florida Property Insurance Guide: What Every Buyer Should Know in 2025

In Florida's ever-changing insurance market, understanding how your policy works can make all the difference between a smooth closing and an unexpected setback. Whether you're buying your first home or navigating a competitive offer situation, knowing what drives your premium—and which homes will be easier to insure—gives you a powerful advantage.

How to Compete With Investors and Cash Offers in South Florida

In Miramar, Pembroke Pines, Hollywood, Weston, Davie, Plantation, and across Broward and Miami-Dade, first-time buyers don't have to out‑cash investors. You win when you show up fully prepared, write clean, confident offers, and make it easy and low‑stress for the seller to say yes, even if you're using financing. This guide is purely strategy-based, not rate-based.

What Credit Score Do You Need to Buy a Home in South Florida (2025 Guide)

Quick answer: Many South Florida buyers can qualify for a mortgage with a credit score as low as 580 for FHA and VA loans, and 620 for most conventional loans. Your score is important, but it's not everything. Strong income, stable employment, and smart credit habits can help you qualify sooner than you think.

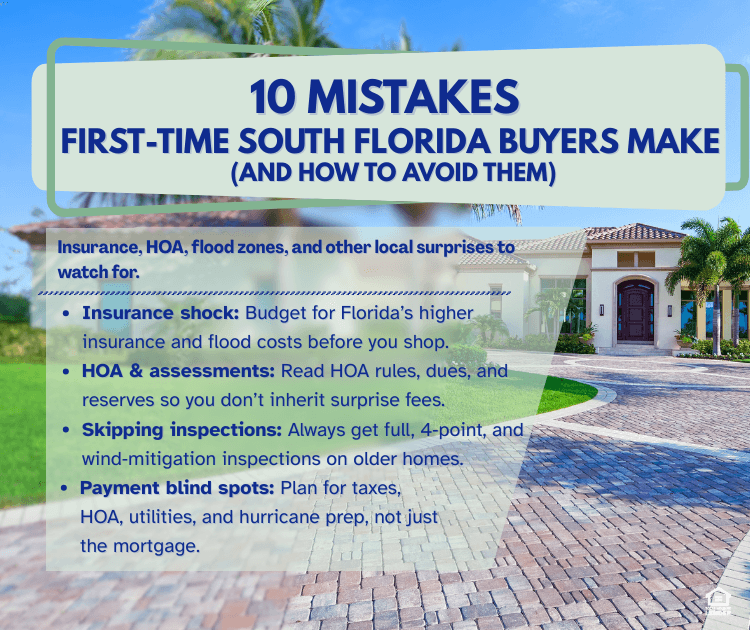

10 Mistakes First-Time Buyers Make in South Florida (And How to Avoid Them)

Quick answer: The biggest mistakes first-time buyers make in South Florida include underestimating insurance costs, skipping flood zone research, ignoring HOA special assessments, waiving inspections, and not budgeting for hurricane prep. Working with an experienced local team helps you avoid these costly missteps and buy with confidence.