Recent Articles

Why Your First Mortgage Payment Might Be Higher Than You Expected in Florida (Escrows Explained)

Your first mortgage payment in Florida often feels higher than expected because it can include prepaid interest (interest from your closing date to the end of that month), plus your full monthly payment (principal, interest, taxes, insurance, and HOA). After the first month, your payment stabilizes at the regular amount. This is why understanding a Florida mortgage payment escrow setup before closing is critical for new buyers. Once these one-time timing costs pass, your payment settles into the amount you were originally quoted.

Escrow Accounts 101: Why Your Payment Changes After Closing (Florida 2026)

Your mortgage payment can change after closing because most Florida lenders escrow your property taxes and homeowners insurance. When those costs increase (or if your lender's initial estimate was off), your escrow account needs more money so your monthly payment adjusts. In Broward, Miami-Dade, and Palm Beach, insurance volatility and property tax reassessments make escrow adjustments common, especially in the first 1–2 years after purchase.

Property Taxes in Florida: What New Buyers Need to Know (Updated for 2026)

In 2026, Florida property taxes typically run 1%–1.5% of your purchase price annually, but the amount can reset when you buy. The Florida Homestead Exemption can reduce your taxable value by up to $50,000, and the Save Our Homes cap limits how much your assessed value can increase each year (3% or CPI, whichever is lower). New buyers in Broward, Miami-Dade, and Palm Beach should budget based on their purchase price, not the seller's old tax bill.

Florida Homestead Exemption: How It Works and When You Actually See Savings (2026)

Florida's homestead exemption can reduce your taxable property value by up to $50,000, but savings don't start until the year after you file. You must file by March 1 to qualify for that tax year, and the home must be your primary residence. For buyers in Broward, Miami-Dade, and Palm Beach, this benefit grows over time thanks to the Save Our Homes cap, which limits how much your assessed value can increase each year.

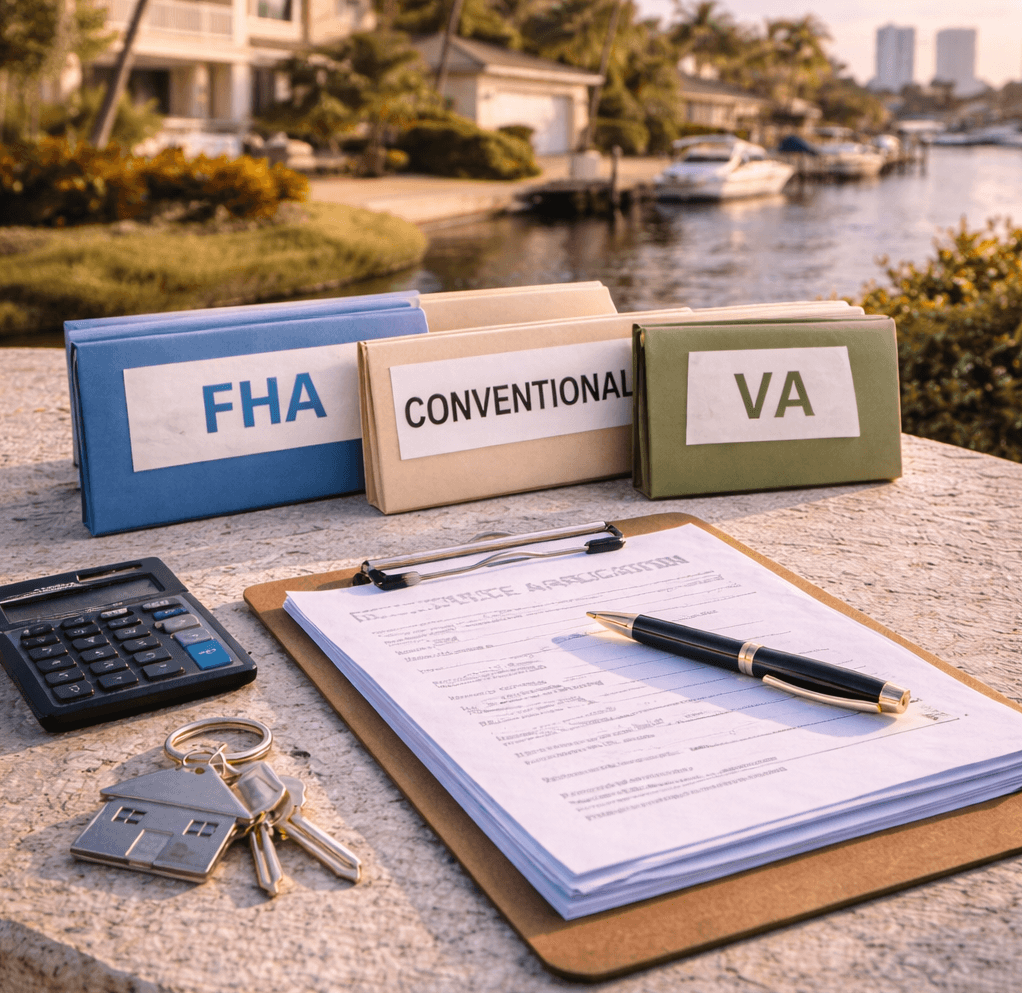

Why Closing Costs Vary by Loan Type (FHA vs Conventional vs VA) in 2026 (Florida)

In Florida, many closing cost line items are similar across loan types (title, escrow/settlement, appraisal, recording, and prepaid taxes/insurance). What changes with FHA vs Conventional vs VA in 2026 is (1) which program-specific fees apply, (2) how much you can finance vs pay at closing, and (3) what rules shape seller credits and allowable fees. For buyers in Broward, Miami-Dade, and Palm Beach, the biggest swing still often comes from insurance + escrow setup, not just lender fees.

Average Closing Costs in Florida: What Buyers Should Budget in 2026

n 2026, many Florida buyers should plan for about 2%–4% of the purchase price in closing costs (not including down payment). On a $450,000 purchase, that's often $9,000–$18,000, depending on the home type, insurance and tax escrows, and whether you're buying in Miami-Dade, Broward, or Palm Beach. The county changes the "feel" of your closing costs mostly through escrows and prepaids (insurance and taxes), not because the "fees list" is totally different.

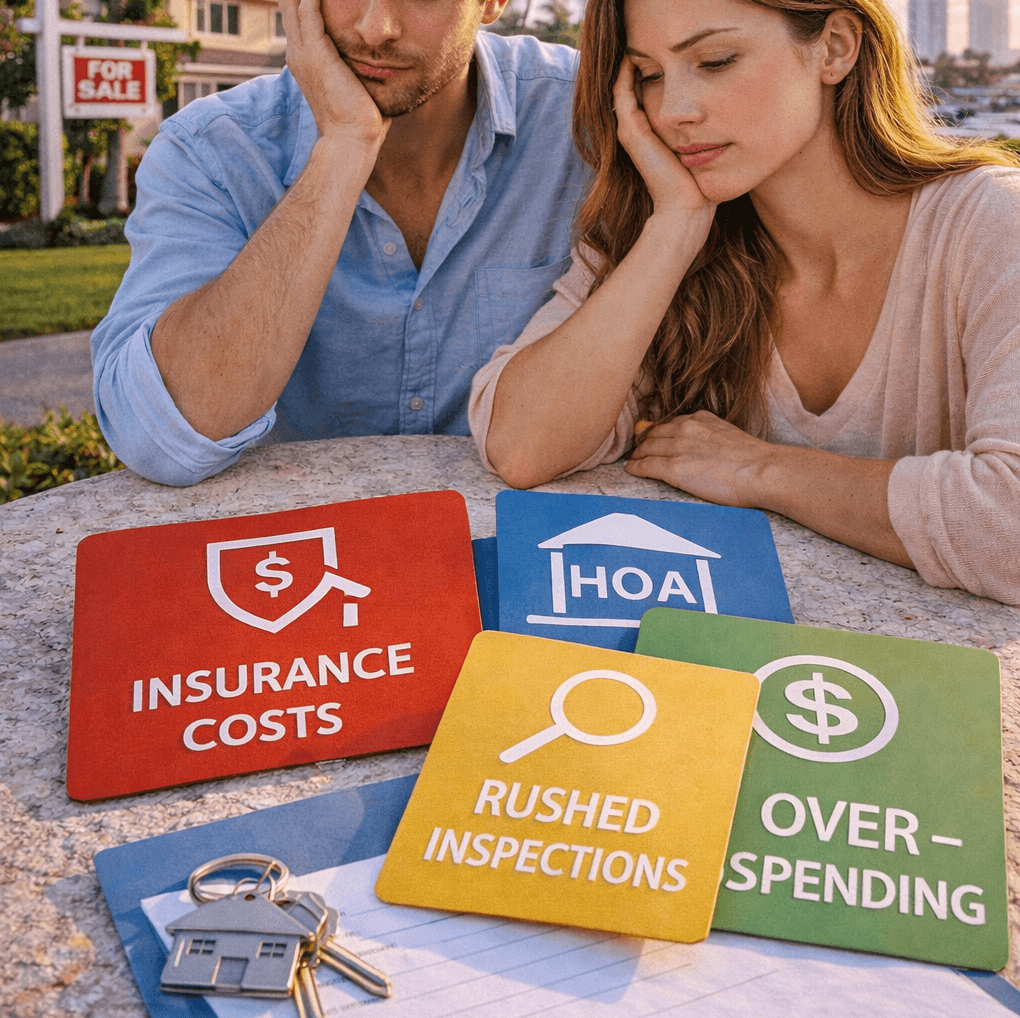

The Most Common Homebuyer Regrets in Florida (2026) and How Smart Buyers Avoid Them

The biggest homebuyer regrets in Florida usually come from the same place: buyers fall in love with the home before they fully understand the real monthly payment and the real risks. In 2026, the most common regrets in South Florida (including Miami) are tied to insurance surprises, HOA/condo costs, rushed inspections, and stretching the budget too far. The good news is these regrets are avoidable with a clear checklist before you offer.

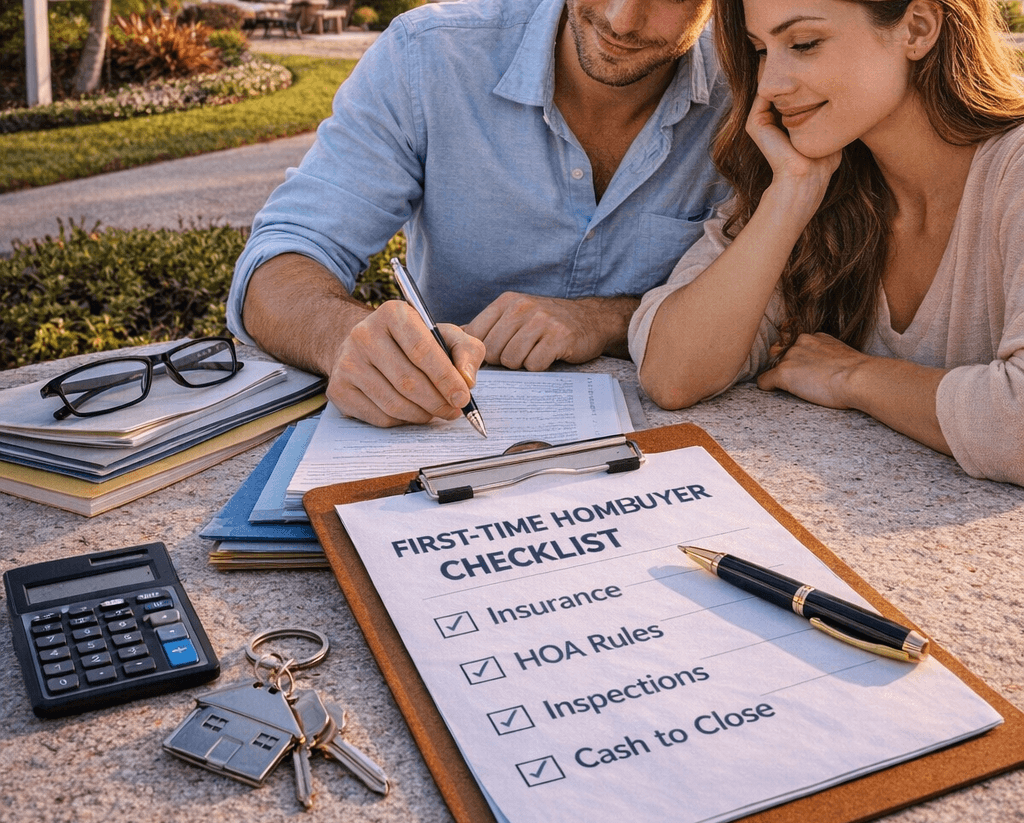

What First-Time Buyers Should Know Before Shopping for Homes in 2026

In 2026, first-time buyers in Florida win by planning around the real constraints that affect approval and affordability: insurance, HOA/condo rules, inspections, and cash-to-close. The "perfect home" is the one you can insure, finance, and comfortably afford after taxes, HOA dues, and escrow, not just the one with the best photos.

Refinancing Isn’t Just About the Rate — It’s About Your Options

Learn what options refinancing makes available to you.