Recent Articles

Refinancing Isn’t Just About the Rate — It’s About Your Options

Learn what options refinancing makes available to you.

Insurance Shopping Timeline: When to Start So It Doesn't Delay Closing (2026)

In 2026, Florida buyers should start insurance planning before they write an offer, and lock in a policy plan immediately after going under contract. Insurance is one of the most common "silent" closing delays in Broward, Miami-Dade, and Palm Beach. Underwriting often requires inspections, roof info, updates, and multiple quote rounds. A simple timeline keeps your loan and closing date protected.

Flood Zones in South Florida: How They Affect Insurance and Your Monthly Payment

In South Florida, your flood zone can affect (1) whether flood insurance is required for financing, (2) how much it costs, and (3) your monthly payment because flood premiums may need to be paid up front or included in escrow. Even inland homes in Broward, Miami-Dade, and Palm Beach can fall in higher-risk flood zones.

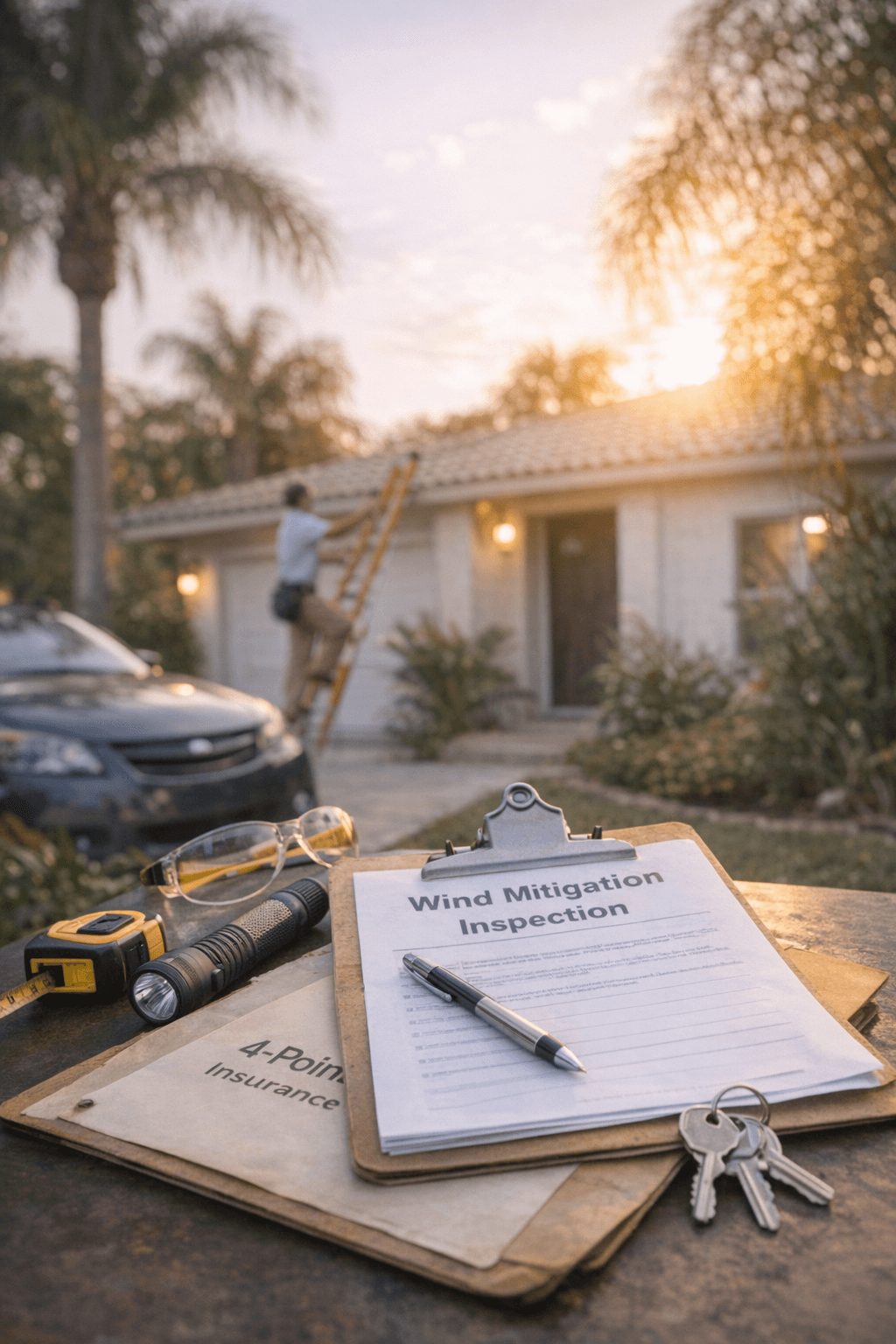

Wind Mitigation vs. 4-Point Inspections in Florida (2026): How Insurance, Premiums, and Closings Are Affected

In 2026, a wind mitigation inspection can help many Florida homeowners qualify for insurance credits by documenting hurricane-resistant features (roof shape, attachment method, impact windows/shutters, and more). A 4-point inspection is different: it helps insurers decide whether they will write the policy at all by evaluating the home's roof, electrical, plumbing, and HVAC. Together, these inspections often determine your premium and whether your deal stays on track, especially in Broward, Miami-Dade, and Palm Beach.

Multiple Offer Strategies That Do Not Require Overpaying (South Florida 2026)

In 2026, you can win in a South Florida multiple-offer situation without overpaying by making your offer feel certain, simple, and low-stress. The winning move is usually not a bigger number. It is cleaner terms, stronger documentation, faster timelines, and smart protections that do not scare the seller.

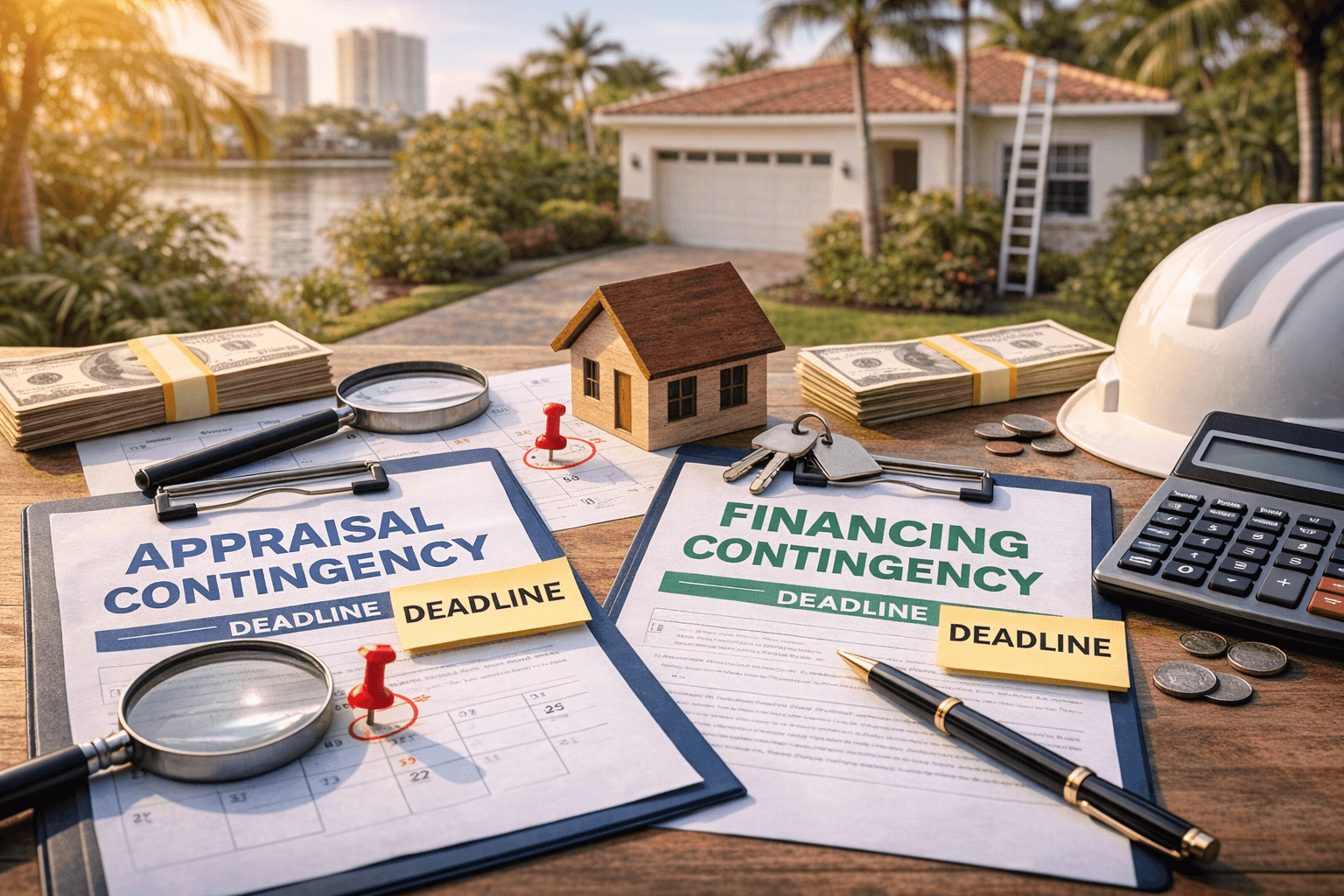

Appraisal Contingency vs Financing Contingency: Florida Contract Basics (2026)

In 2026, Florida buyers protect themselves with contract contingencies that define when they can cancel and get their deposit back. The financing contingency protects you if your loan is not approved by a specific deadline. The appraisal contingency protects you if the home appraises low. They are related, but they are not the same and missing either deadline can put your earnest money at risk.

Inspection Negotiations in 2026: What Florida Buyers Can Reasonably Ask For

In 2026, the strongest Florida inspection negotiations are focused, safety-first, and evidence-based. Ask for repairs (or credits) on major systems and safety issues, not cosmetics. Use your inspection period to confirm condition, clarify insurance risks, and decide whether the home still makes sense.

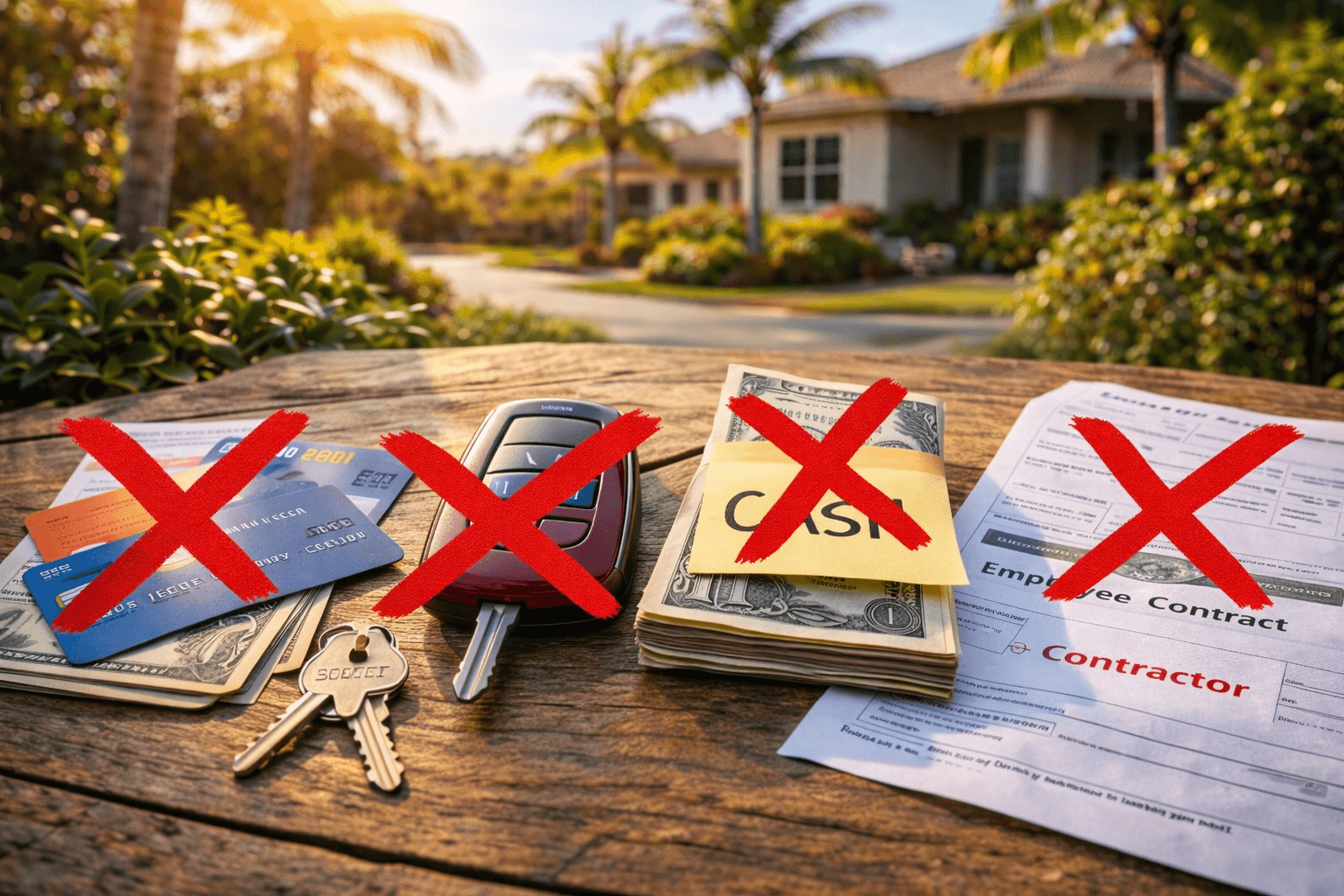

The "Do Not Do This" List After Mortgage Pre-Approval in Florida (2026)

In Florida, many deals don't fall apart because the buyer "didn't qualify." They fall apart because something changes after pre-approval—often discovered during final underwriting and pre-funding verifications. New debt, new credit, undocumented deposits, or job changes can trigger delays or denials. Keep your profile stable until you close.

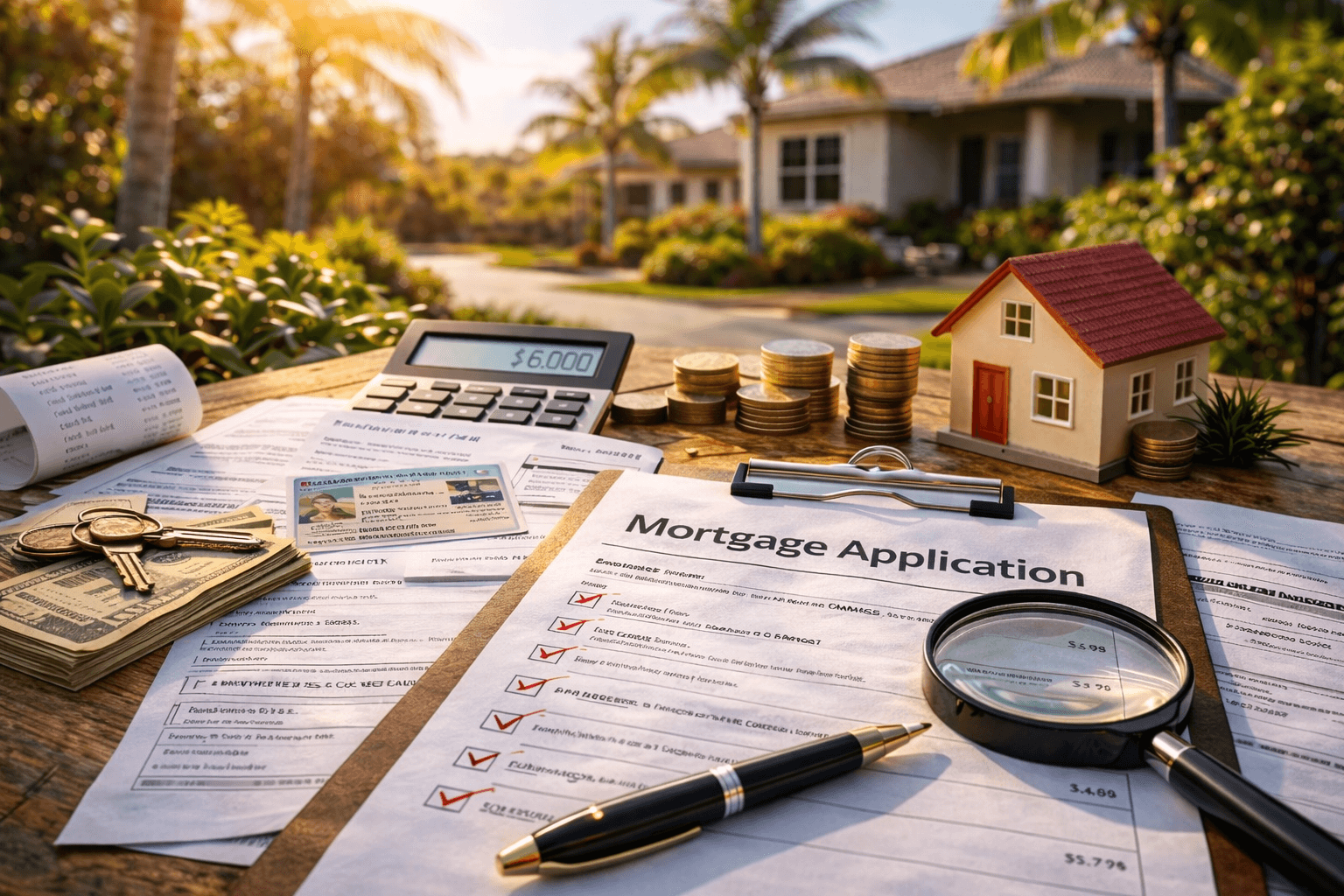

What Mortgage Underwriters Actually Look For in 2026 (And How to Prep Your File Early)

Underwriters don't "judge" your file. They verify that your income, assets, credit, and the property meet guidelines. In 2026, the fastest approvals happen when your documents match your story, your bank statements are clean, and Florida items like insurance and HOA/condo docs are handled early.