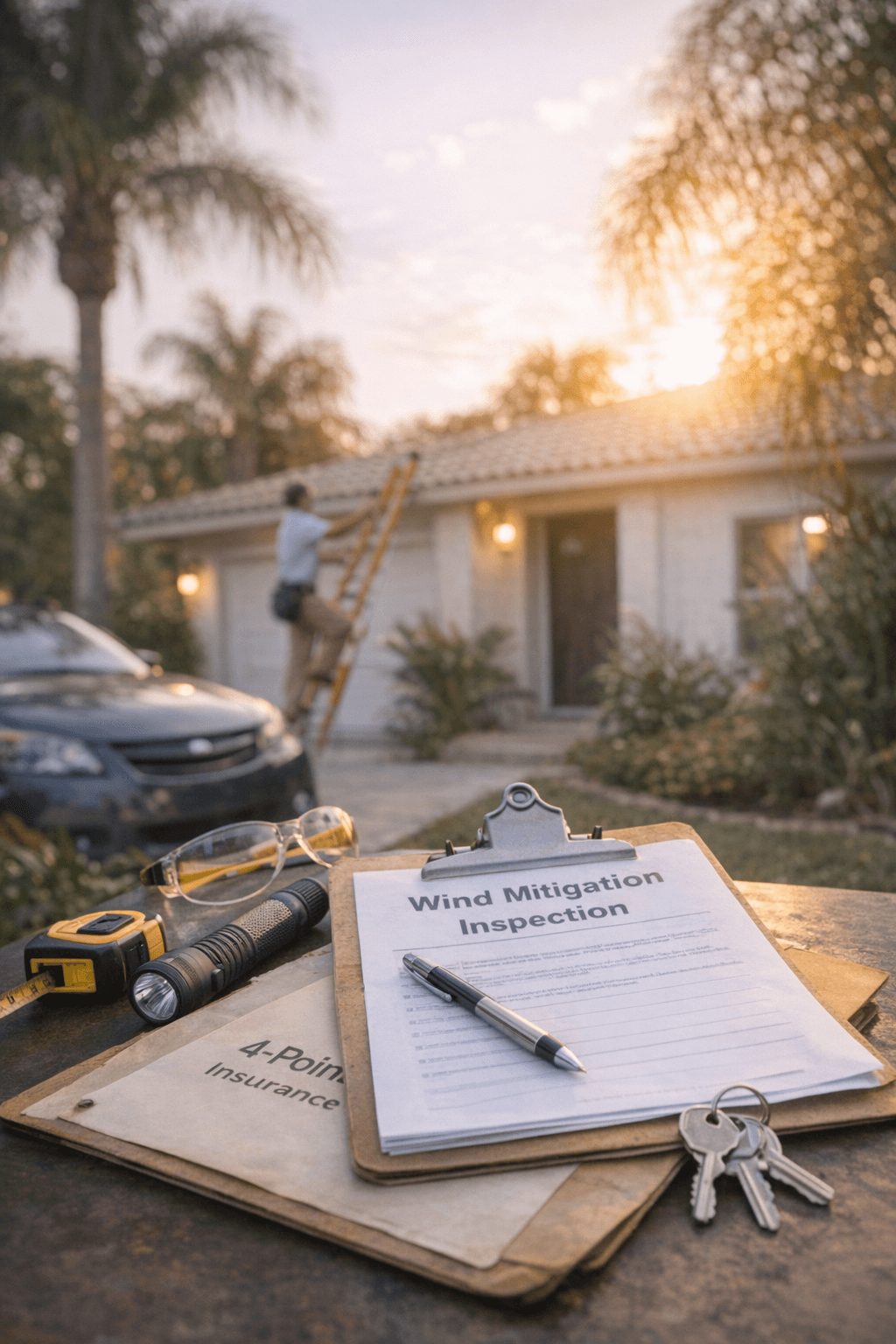

Wind Mitigation vs. 4-Point Inspections in Florida (2026): How Insurance, Premiums, and Closings Are Affected

In 2026, a wind mitigation inspection can help many Florida homeowners qualify for insurance credits by documenting hurricane-resistant features (roof shape, attachment method, impact windows/shutters, and more). A 4-point inspection is different: it helps insurers decide whether they will write the policy at all by evaluating the home's roof, electrical, plumbing, and HVAC. Together, these inspections often determine your premium and whether your deal stays on track, especially in Broward, Miami-Dade, and Palm Beach.

If you're buying in Miramar, Pembroke Pines, Hollywood, Weston, or nearby areas, this is one of the smartest "small steps" you can take to avoid insurance surprises that affect both affordability and closing timelines.

Many buyers don't realize insurance is now one of the biggest variables in affordability, alongside taxes and HOA fees. That's why understanding the true cost of owning a home in South Florida matters before you write an offer.

1) Wind mitigation vs. 4-point: what's the difference?

Wind mitigation (discount-focused):

A specialized report that documents wind-resistance features

Purpose: qualify for insurance credits and premium reductions

4-point inspection (insurability-focused):

A condition report covering roof, electrical, plumbing, and HVAC

Purpose: determine whether the insurer will issue a policy or require repairs first

Bottom line: Wind mitigation can reduce your monthly cost. A 4-point inspection can prevent a last-minute insurance denial that delays or kills the deal. Insurance has become a major part of the true cost of owning a home in South Florida, not just something handled after closing.

2) What a wind mitigation inspection checks (and why it lowers premiums)

Wind mitigation inspectors typically document:

Roof shape (hip roofs often receive better credits than gable roofs)

Roof deck attachment (how the decking is fastened)

Roof-to-wall attachment (clips or straps improve ratings)

Secondary water resistance

Opening protection (impact windows, shutters, impact-rated doors/garage)

The more verified protections you have, the more likely you are to receive meaningful credits. This is one of the few areas where buyers can actively influence cost, which helps explain why Florida home insurance is so high, and how buyers can navigate it instead of guessing.

3) What a 4-point inspection can "flag" (and how it affects your deal)

A 4-point inspection is where many Florida contracts slow down or fall apart. Common red flags include:

Roof age or limited remaining life

Electrical concerns (outdated panels, unsafe wiring)

Plumbing issues (aging supply lines, leaks)

HVAC systems near end-of-life

If repairs are required before insurance can be bound, buyers may be forced into rushed negotiations. This is especially important for condos and attached properties, where insurance eligibility and financing rules overlap. Buyers should understand why some Florida condos still aren't mortgage-eligible in 2026 and how to check early before writing an offer.

Buyer tip: If insurance is flagged late in the process, it can impact loan approval timelines. Coordinating inspections, insurance quotes, and financing early is one of the easiest ways to avoid last-minute stress.

4) When buyers should order these inspections (timing matters)

To protect your contract timeline in 2026:

Request insurance quote scenarios early, even before offering if possible

Once under contract, order both wind mitigation and 4-point inspections early in your inspection period

Address flagged items immediately with your agent and lender before deadlines tighten

Insurance delays are now one of the most common reasons closings are pushed back, which is why buyers should plan based on what Florida home insurance actually costs today, not outdated assumptions.

5) How buyers use these reports to lower costs (without guessing)

Smart buyers use these inspections to:

Confirm impact protection is fully documented, not just verbally claimed

Negotiate repairs or credits that improve insurability

Compare homes based on total ownership cost, not just purchase price

This is especially important for buyers using low down payment programs. Even when you don't need 20% down to buy a home in South Florida, insurance premiums and required repairs can materially affect cash-to-close and monthly affordability.

Final takeaway

In 2026, Florida insurance is not a "later" problem. Wind mitigation inspections can reduce premiums, and 4-point inspections confirm whether a home is insurable at all. When handled early, these reports protect your budget, your loan approval, and your closing timeline, especially in Broward, Miami-Dade, and Palm Beach.

This is especially relevant for buyers purchasing older homes in Miramar, Pembroke Pines, Hollywood, and Weston, where roof age and system updates often determine insurability.

Handled late, they can derail an otherwise solid deal.

Next steps

Get pre-approved in minutes: Start your application now

Explore Florida homebuyer programs: Learn about low-down-payment and first-time buyer options

Book a strategy call: Schedule a call to review your plan and avoid costly mistakes

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender