Why Florida Home Insurance Is So High and How Buyers Can Navigate It

Florida home insurance is high due to hurricane exposure, rising construction costs, and a history of litigation that increases claim expenses. Fewer private insurers and stricter underwriting also force many buyers into higher premiums or Citizens coverage.

If you've been shopping for a home in Miramar, Pembroke Pines, Hollywood, Weston, or anywhere in Broward County, you've probably seen the same thing: insurance quotes that feel just as stressful as the home price.

As a South Florida mortgage broker, we talk every week with Florida first-time homebuyers who are surprised to learn how much insurance can impact their monthly payment. Once you understand why insurance is so expensive, and what you can do about it, you'll then make clearer decisions about where and what to buy.

For more planning help, read our guides on FHA loans Florida and low-down-payment options for buyers across Broward, Miami-Dade, Palm Beach, Orlando, Tampa, and Jacksonville.

Why Are Insurance Companies Leaving Florida?

Several forces are hitting Florida insurers at once:

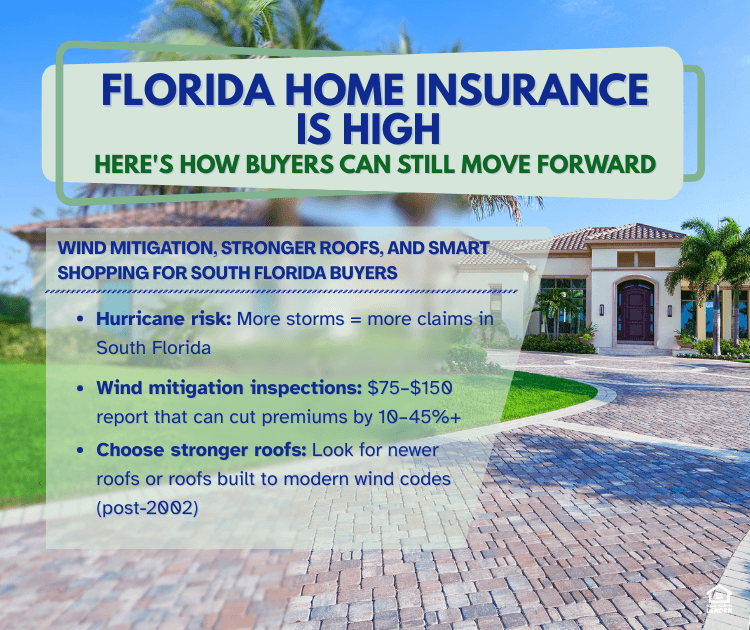

Hurricane and storm risk. Major storms in South Florida mean more claims, especially in Miami-Dade and Palm Beach.

High rebuilding costs. Labor, materials, and code requirements in Broward County drive up claim costs.

Litigation and claim disputes. Florida's high volume of lawsuits over roof damage affects everyone's premiums.

Combined, some companies decide it's simpler to stop writing new policies or exit Florida altogether.

What This Means for Buyers in South Florida

If you're getting pre-approved for a Miramar mortgage or comparing Broward home loans, insurance is a core part of your budget.

Two similar homes in Broward or Miami-Dade can have very different insurance quotes.

Older roofs or outdated wiring make coverage more expensive. Properties built before 2002 often face stricter underwriting.

Certain properties may only qualify with Citizens Property Insurance, the state-backed insurer of last resort.

Bring insurance into the conversation early, just like you do with loan type and down payment.

Which Home Features Affect Insurance Most?

Roof age and shape: Roofs older than 15 years often face surcharges. Hip roofs typically get better rates than gable roofs.

Opening protections: Impact windows, hurricane shutters, and fortified garage doors can significantly reduce premiums through wind mitigation credits.

Year built: Newer homes built to modern Florida Building Code standards (post-2002) typically qualify for better rates.

Practical Ways Buyers Can Protect Themselves

You can't control hurricanes, but you can control how prepared you are. Here are strategies that work for clients across Broward, Miami-Dade, Palm Beach, Orlando, Tampa, and Jacksonville:

1. Prioritize Homes with Strong Roofs and Wind Protections

Look for newer roofs or roofs built to updated wind codes. Ask about shutters, impact windows, and fortified features.

2. Order a Wind Mitigation Inspection

Before or right after you go under contract, consider a wind mitigation inspection. This report can qualify you for credits that reduce premiums by 10–45% or more. The inspection typically costs $75–$150 but can save hundreds or thousands annually.

3. Understand Citizens Property Insurance

If private carriers won't write a policy, your agent may place you with Citizens Property Insurance, the state-backed option designed as an insurer of last resort.

4. Shop Early and Compare Carefully

Don't wait until the week of closing. Have your real estate agent connect you with an independent insurance agent as soon as you go under contract. Get at least two to three quotes.

Putting It All Together

Florida's insurance crisis is real, but it doesn't have to stop you from becoming a homeowner.

If you choose homes with strong roofs and wind protections, get wind mitigation inspections, understand options like Citizens Property Insurance, and shop coverage early and strategically, you'll be in a much stronger position to buy confidently in Miramar, Broward County, Miami-Dade, Palm Beach, Orlando, Tampa, or Jacksonville.

FAQ

Q: Why is home insurance so expensive in Florida?

Florida insurance is costly because of hurricane risk, higher rebuilding costs, and a history of heavy litigation.

Q: Does wind mitigation lower insurance in Florida?

Yes. A wind mitigation inspection documents protective features and can reduce premiums by 10-45% or more.

Ready to Move Forward Despite Florida's Insurance Costs?

Whether you're buying in Miramar, comparing Broward vs. Miami-Dade quotes, or unsure if a home's roof will qualify, we can help you run scenarios early.

Apply online in minutes: Start your application now

Explore Florida homebuyer programs: Learn about low-down and first-time buyer options

Book a strategy call: Schedule a call to review your numbers and insurance scenarios

If you're thinking about buying or refinancing in South Florida, reach out today to explore your best options.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender