The "Do Not Do This" List After Mortgage Pre-Approval in Florida (2026)

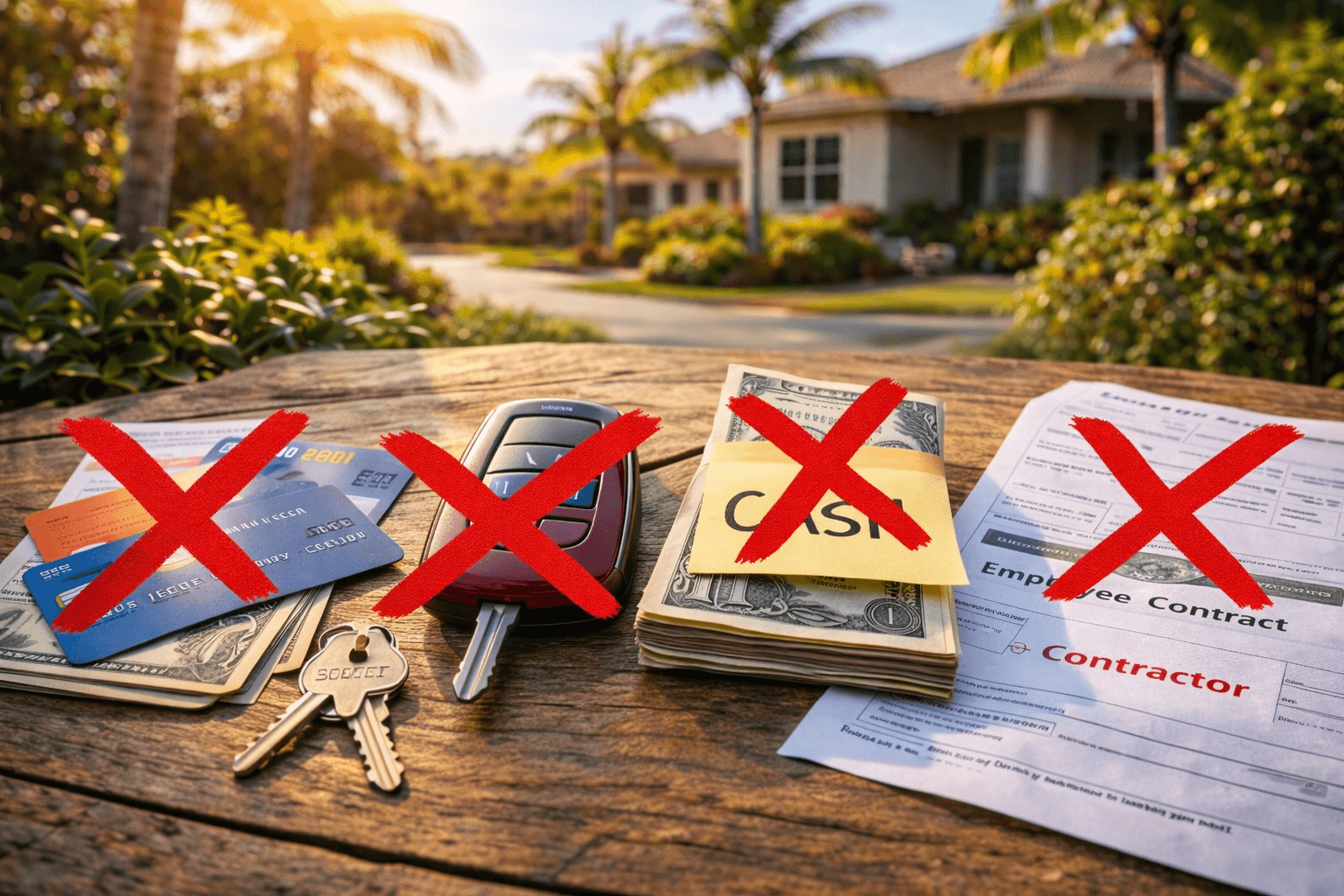

In Florida, many deals don't fall apart because the buyer "didn't qualify." They fall apart because something changes after pre-approval—often discovered during final underwriting and pre-funding verifications. New debt, new credit, undocumented deposits, or job changes can trigger delays or denials. Keep your profile stable until you close.

Getting pre-approved feels like the finish line. In reality, it's the starting gun. Between contract and closing, your lender will re-check your credit, income, employment, and funds. One "small" move can trigger new conditions, delays, or a last-minute denial.

Here's the Florida buyer's do-not-do-this list (especially important in Broward, Miami-Dade, and Palm Beach).

1) Do not open new credit (even if it's "0% interest")

Avoid: new credit cards, store cards, furniture financing, "buy now, pay later," personal loans.

Why it kills deals: New accounts can drop your score and increase your debt-to-income ratio (DTI). Underwriting may require updated documentation or re-run the approval.

Do instead: Pause new credit until after funding. If you truly have to, ask your lender first.

2) Do not buy or lease a car before closing

Even one car payment can change the whole file.

Why: A new auto loan increases DTI fast. It also triggers a new credit pull and sometimes new reserve requirements.

Rule of thumb: If it has a monthly payment, underwriting counts it.

3) Do not run up credit card balances

Avoid: charging moving costs, deposits, travel, appliances, or holiday spending on cards.

Why: Higher utilization can lower scores quickly and raise minimum payments. That's a double hit.

Do instead: Keep balances steady or pay them down. Don't "float" big purchases.

4) Do not make cash deposits (and don't move money around casually)

Avoid: cash deposits, random Zelle/Venmo bundles, and unexplained transfers between accounts.

Why: Underwriting must "source" large deposits. "Cash I saved at home" is usually not documentable. Even deposits from side work, tips, or selling personal items can require documentation.

Do instead: Keep a clean paper trail. If family is helping, follow documented gift rules (gift letter + donor ability + proof of transfer).

Related reading: Self-Employed in Broward? Here's How Gift Funds and Non-QM Loans Help You Buy a Home Faster.

5) Do not change jobs, switch pay structure, or become 1099 mid-deal

Avoid: switching employers, moving from salary to commission, becoming self-employed, starting a new business.

Why: Lenders re-verify employment close to closing. A change can require new calculations and can delay (or stop) the deal.

Do instead: If a change is unavoidable, tell your lender immediately.

Not sure if something you're planning is "safe"? A 2-minute check with your lender can save weeks of delays later.

6) Do not co-sign for anyone

Even if you "won't be paying it," underwriting may still count that debt.

7) Do not go silent on document requests

Underwriting is deadline-driven—and so is your contract. Missing one request can delay closing and put your contract at risk.

If you want a behind-the-scenes explanation of what underwriting verifies, read:

What Underwriters Actually Look For in 2026 (And How to Prep Your File Early)

8) Do not assume the payment is final until insurance and HOA are confirmed

In Florida, the deal can still shift if:

insurance comes in higher than expected

HOA/condo docs create delays or restrictions

HOA dues or special assessments change the true monthly payment

These items are often property-specific and can't be finalized until after contract.

Start here: Florida Home Insurance in 2026: What Buyers Must Budget For and

HOA Fees in Florida: What's Reasonable and What's a Red Flag in 2026.

9) Do not forget contract deadlines (earnest money risk)

A strong loan file won't save a missed inspection or financing deadline.

The "safe until closing" checklist (copy/paste)

[ ] No new credit applications

[ ] No new loans or car purchases

[ ] Keep credit card balances steady

[ ] No cash deposits without lender approval

[ ] No job or pay-structure changes

[ ] Don't co-sign for anyone

[ ] Respond to document requests fast

[ ] Confirm insurance + HOA early

[ ] Ask my lender before making any financial change

Next steps

Want a clean, low-stress closing? The goal after pre-approval is simple: keep your profile stable until you get the keys.

Get pre-approved in minutes: Start your application now

Explore Florida homebuyer programs: You don't need 20% down

Book a strategy call: Schedule a call

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender