Recent Articles

Builder Incentives Explained (2026): What Actually Lowers Your Cash to Close in Florida

In 2026, the builder incentive that most directly lowers your cash to close is a closing cost credit that pays for title/settlement fees, lender fees, and prepaid items (taxes + insurance escrows). Design credits help your home, but usually don't reduce closing cash unless they replace upgrades you would have paid for out of pocket.

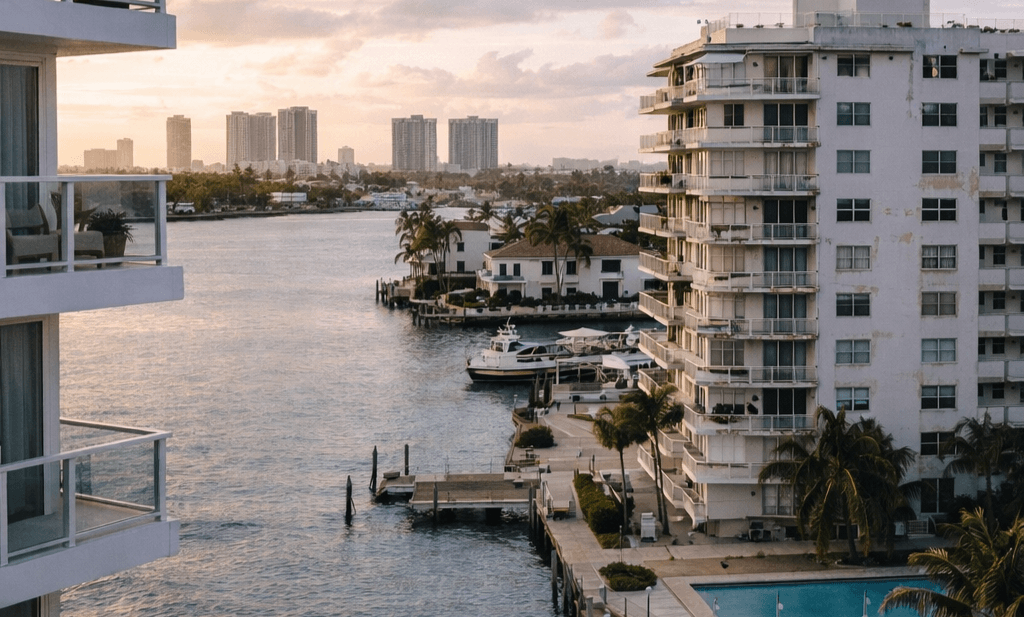

New Construction Homes in South Florida (2026): What Buyers Should Really Expect

In 2026, buying new construction in South Florida comes down to five things: true all-in pricing, real builder incentives, realistic timelines, HOA and insurance costs, and proper inspections. Buyers who focus on these avoid budget surprises and contract delays.

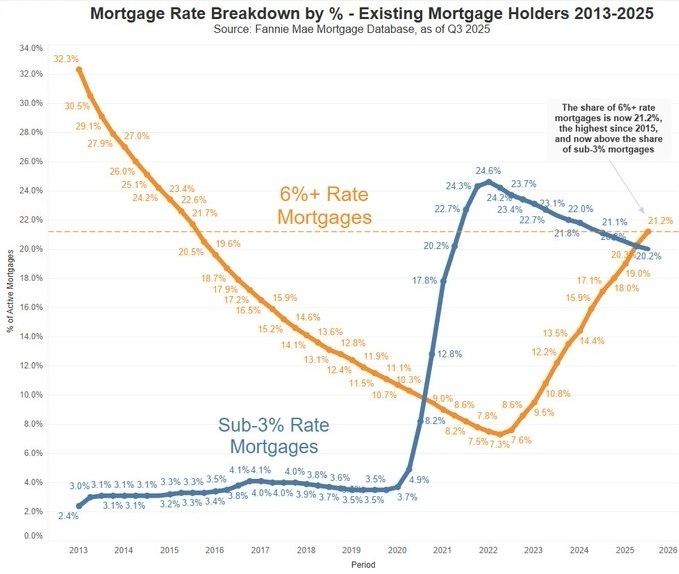

Lock-in Effect: Something big just happened in the U.S. Housing Market

Find out what the experts are anticipating for 2026 housing

Top Affordable Broward County Neighborhoods for Buyers in 2026

Quick answer: In 2026, "affordable" in Broward usually means focusing on townhomes and condos, expanding your search beyond the most premium school zones, and watching insurance + HOA fees as closely as the purchase price. Many first-time buyers find the best entry points in pockets of Lauderhill, Sunrise, Tamarac, Margate, parts of Plantation and Davie, and select communities in Hollywood, Miramar, and Pembroke Pines.

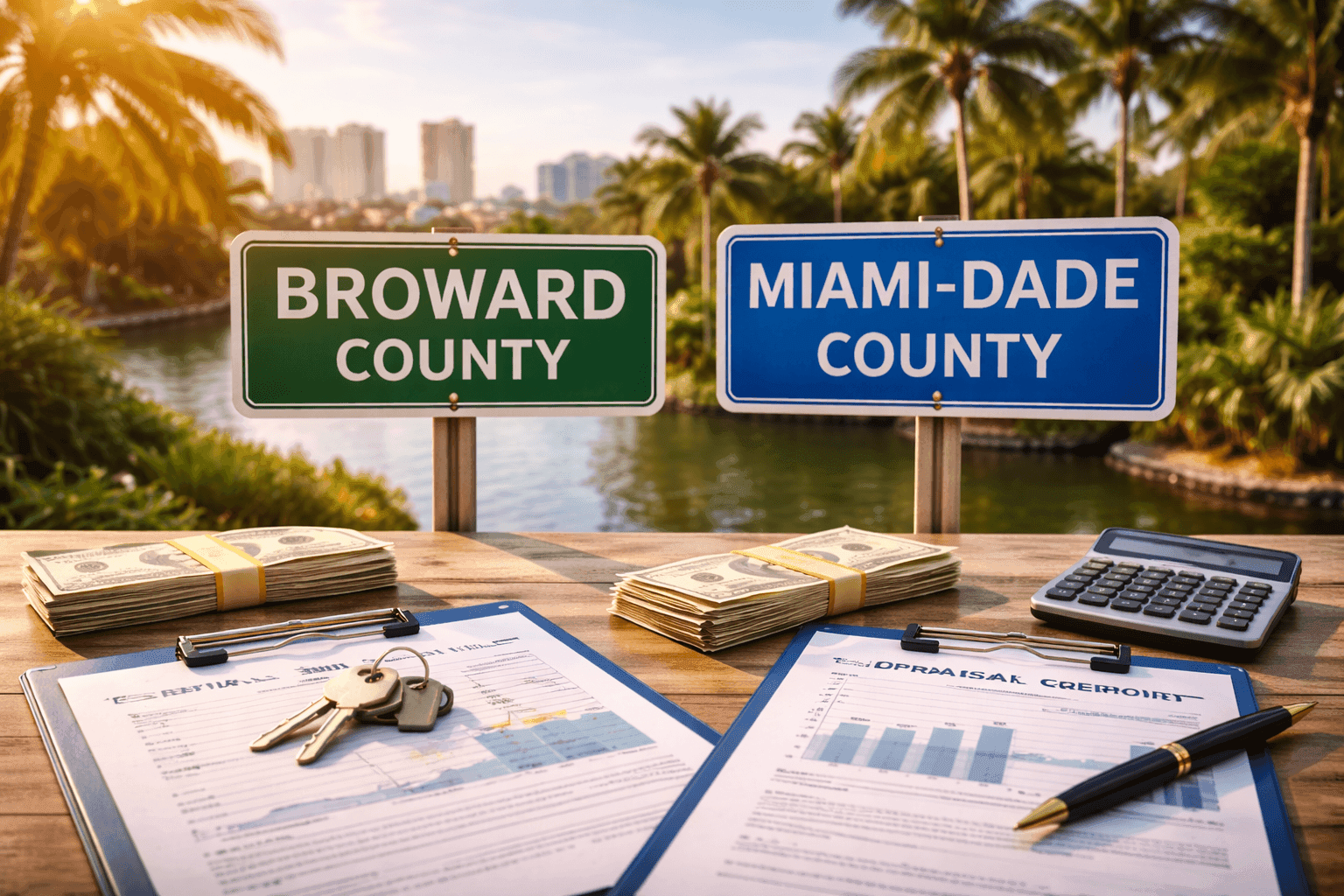

Broward vs Miami-Dade: Where Buyers Get More Value in 2026

Quick answer: In 2026, many buyers get more "value per dollar" in Broward because they can often buy more space, newer construction, or a more predictable HOA/insurance profile at a lower price than comparable areas in Miami-Dade. Miami-Dade can still be the better value if your job, lifestyle, or commute is truly Miami-centered, or if you're targeting specific pockets where transit access and long-term demand justify the premium.

Best Miami Neighborhoods for Buyers Under 40 in 2026 (Lifestyle + Commute Guide)

For buyers under 40 in 2026, the “best” Miami neighborhood is the one that matches your commute and your weekly routine. If you want walkability and nightlife, focus on Brickell, Downtown, Edgewater, Wynwood, and Midtown. If you want greener streets and a calmer vibe while staying close to job hubs, look at Coconut Grove and Coral Gables. If you want more space and easier parking with strong highway access, consider Doral.

HOA Fees in Florida: What's Reasonable and What's a Red Flag in 2026

In 2026, "normal" HOA fees in Florida depend on the property type. Many townhome and gated communities in Broward run $150–$400/month, while many condos in Miami-Dade, Broward, and Palm Beach run $350–$800+/month (and luxury buildings can be higher). The real risk isn't the fee: it's what it may be hiding: weak reserves, rising insurance, and looming special assessments.

Why Some Florida Condos Still Aren't Mortgage-Eligible in 2026 (And How to Check Early)

In 2026, some Florida condos are still not mortgage-eligible because of building-level issues like weak reserves, big special assessments, structural concerns, heavy litigation, investor concentration, or poor financials. These "non-warrantable" condos are harder to finance and sometimes cash-only. Buyers can avoid surprises by running a simple early building check with their agent and lender.

Florida Condo Buying in 2026: What Changed After SB 154

SB 154 and related laws pushed Florida condos toward better safety, stronger reserves, and stricter oversight. In 2026, that means buyers must look beyond granite countertops and pool views and focus on milestone inspections, SIRS (Structural Integrity Reserve Studies), reserve funding, and special assessments. These changes improve safety but can also mean higher dues and tougher mortgage approval in some buildings.