HELOC vs. Cash‑Out Refinance in Florida: Which Is Better for Renovations and Debt Consolidation? | EZ Funding Group, Inc.

Jacksonville, Orlando, Tampa & Miami homeowners: discover when to use a HELOC vs. cash-out refinance for renovations, debt consolidation, and home equity access.

Staring at a $40,000 Kitchen Quote in Pembroke Pines? Your Home's Equity Could Fund It

Florida homeowners are sitting on record equity. If you bought in Jacksonville, Orlando, Tampa, or Miami in 2020, your home has likely gained $100,000+ in value. That equity isn't just a number on paper, it's also a financial tool you can use for renovations, debt consolidation, or major expenses. But should you tap it with a HELOC, cash-out refinance, or home equity loan?

When NOT to Use Home Equity

Before we dive in, here's when you should not tap your equity: don't use a HELOC if you lack spending discipline, don't cash-out refinance if you're close to paying off your mortgage, and don't tap equity for depreciating assets like cars or vacations.

Qualification Requirements

Credit score

HELOC: 680+

Cash-out refinance: 620+

Home equity loan: 640+

Debt-to-income (DTI): Under 43%

Equity remaining after loan: At least 15% to 20%

Timelines

HELOC: 2 to 4 weeks

Cash-out refinance: 30 to 45 days

Home equity loan: 2 to 3 weeks

Closing costs

HELOC: $0 to $500 (often waived)

Cash-out refinance: 2% to 5% of loan amount

Home equity loan: $500 to $2,000

What Is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by your home. Borrow up to 80-90% of your home's value minus your mortgage balance, and pay interest only on what you use.

Best for: Phased renovations, emergency fund backup, ongoing expenses like college tuition or medical bills.

Jacksonville example: A homeowner with $150K equity opened a $100K HELOC, drew $40K for a kitchen renovation, and paid interest only on that $40K, saving thousands versus a full cash-out refinance.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new, larger loan. You receive the difference in cash and repay it over 15 to 30 years with a fixed monthly payment.

Best for: Debt consolidation, large one-time expenses like home additions, or lowering your overall monthly payment when juggling multiple debts.

Tampa example: A couple refinanced their $300K mortgage into a $375K loan, pulled out $75K to pay off credit card debt and fund a home office. Their mortgage payment increased by $350, but they eliminated high credit card payments, saving them $850/month overall.

Caution: Another Tampa buyer locked all their equity into a cash-out refi for a single project. Six months later, they needed roof repairs and couldn't access more funds. If you need flexibility, a HELOC may be smarter.

What Is a Home Equity Loan?

A home equity loan is a lump-sum loan with a fixed payment and fixed term, separate from your primary mortgage.

Best for: One-time projects with a known cost (pool, roof replacement) or keeping your existing low mortgage payment when you don't want to refinance.

Duval County example: A homeowner with a low payment from 2020 took a $60K home equity loan instead of refinancing. They kept their low primary payment and funded a full roof replacement

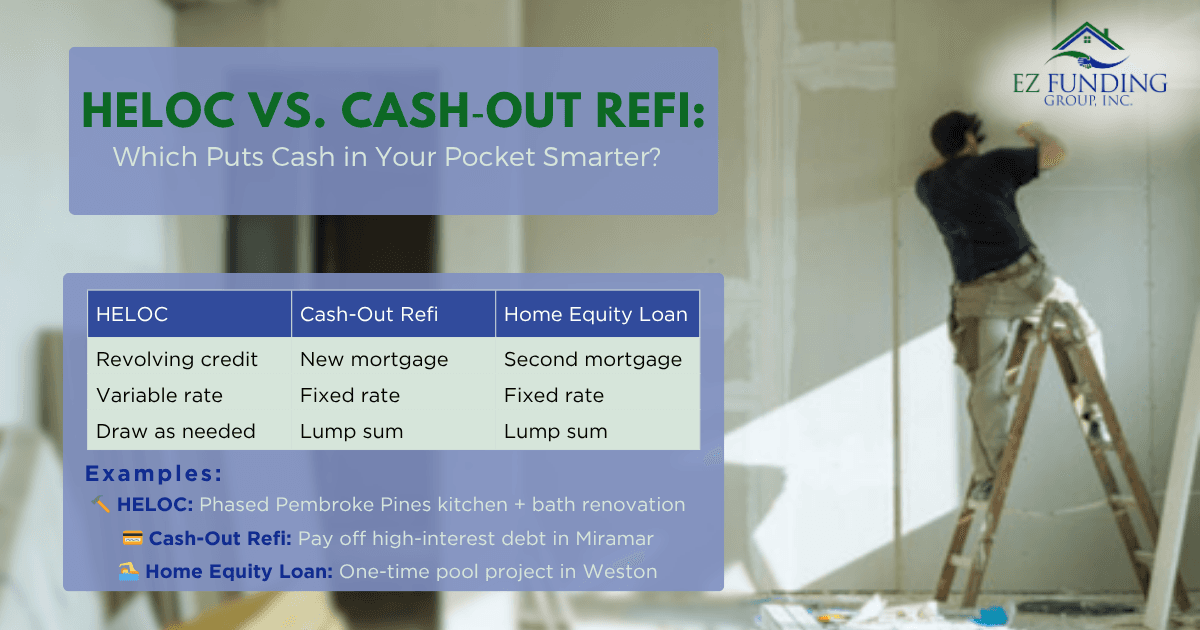

Side-by-Side Comparison

How to Decide: 3 Questions to Ask

1. Do I need all the money now, or over time? All now → Cash-out refi or home equity loan. Over time → HELOC.

2. How's your current mortgage payment? Low payment from years ago → Keep it with a HELOC or home equity loan. High payment or want to consolidate debts → Cash-out refi might make sense.

3. Do I want a fixed or variable payment? Fixed and predictable → Cash-out refi or home equity loan. Variable and flexible → HELOC.

A Common Pembroke Pines Decision

Maria and Carlos bought their Pembroke Pines home in 2019 for $350K. It's now worth $475K. They have $125K in equity and want to renovate their kitchen ($40K now) and bathroom ($25K next year).

HELOC option: Open a $100K line, draw $40K now and $25K later. Keep their low mortgage payment and pay interest only on what they use.

Cash-out refi option: Refinance into a $415K loan and take $65K cash, but lose their low payment and increase their monthly payment significantly.

Best choice? HELOC. They keep their low payment, access funds as needed, and avoid refinancing

All examples are for educational purposes only. Actual qualification and terms depend on credit profile, property type, and lender guidelines.

Next Steps for South Florida Homeowners

Ready to tap your home's equity? Here's how to get started:

Know your equity: Get pre-approved to see how much you can access

Compare your options: We'll walk you through HELOC, cash-out refi, and home equity loan scenarios based on your goals

Book a 15-minute call: Schedule here

Explore all loan programs: Review your options here

If you're thinking about accessing your home's equity in Broward, Miami-Dade, or Palm Beach, reach out today to explore your best options.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender