Have Student Loans? You Can Still Buy a Home in South Florida. Here's How to Qualify for a Mortgage in Miami-Dade, Broward & Palm Beach Counties.

Student loans and homeownership in South Florida? It’s possible! Learn how income-driven repayment plans and debt-to-income strategies help you qualify for a mortgage in Broward, Miami-Dade, Palm Beach, and beyond.

Many hardworking professionals in South Florida dream of buying their first home but feel held back by student loans. The truth is, your degree doesn’t have to delay your homeownership goals.

At EZ Funding Group, we specialize in helping borrowers with student loans qualify for mortgages in Miramar, Pembroke Pines, Hollywood, and across Broward, Miami-Dade, and Palm Beach Counties. By understanding how lenders calculate your debt-to-income ratio (DTI) and how your repayment plan can work in your favor, you’ll be one step closer to homeownership.

How Student Loans Impact Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is one of the most important factors lenders consider when reviewing your mortgage application. It's simply the percentage of your monthly income that goes toward debt payments, including student loans, credit cards, car loans, and your future mortgage.

Here's where it gets interesting: how lenders count your student loan payment depends on your repayment plan. If your loans are in forbearance or deferment, many lenders will still factor in a monthly payment, typically 0.5% to 1% of your total balance. But if you're on an income-driven repayment (IDR) plan, lenders can use your actual monthly payment, which is often much lower and can significantly improve your DTI.

For Florida first-time homebuyers, this can be a game-changer. A lower DTI means you can qualify for a higher loan amount or meet the requirements for popular programs like FHA loans, which are widely available through South Florida mortgage brokers.

Here's a real-life example: Let’s say you owe $40,000 in student loans. Without an income-driven repayment plan, lenders might assume a monthly payment of $200–$400. However, with an IDR plan, your monthly payment could be as low as $75. This difference could increase your borrowing power, potentially allowing you to qualify for a home in competitive markets like Pembroke Pines or Weston. The lower your DTI, the more home you can afford!

Income-Driven Repayment Plans Can Help You Qualify

If your student loan payments are manageable under an IDR plan, such as Income-Based Repayment (IBR) or Pay As You Earn (PAYE), you can use that lower payment when applying for a mortgage. Most lenders will require documentation showing your payment amount and that you've been making consistent payments.

This is especially helpful in competitive markets like Hollywood, Weston, or Coral Springs, where every dollar of buying power counts. By reducing the monthly debt lenders consider, you open the door to better loan options and more favorable terms.

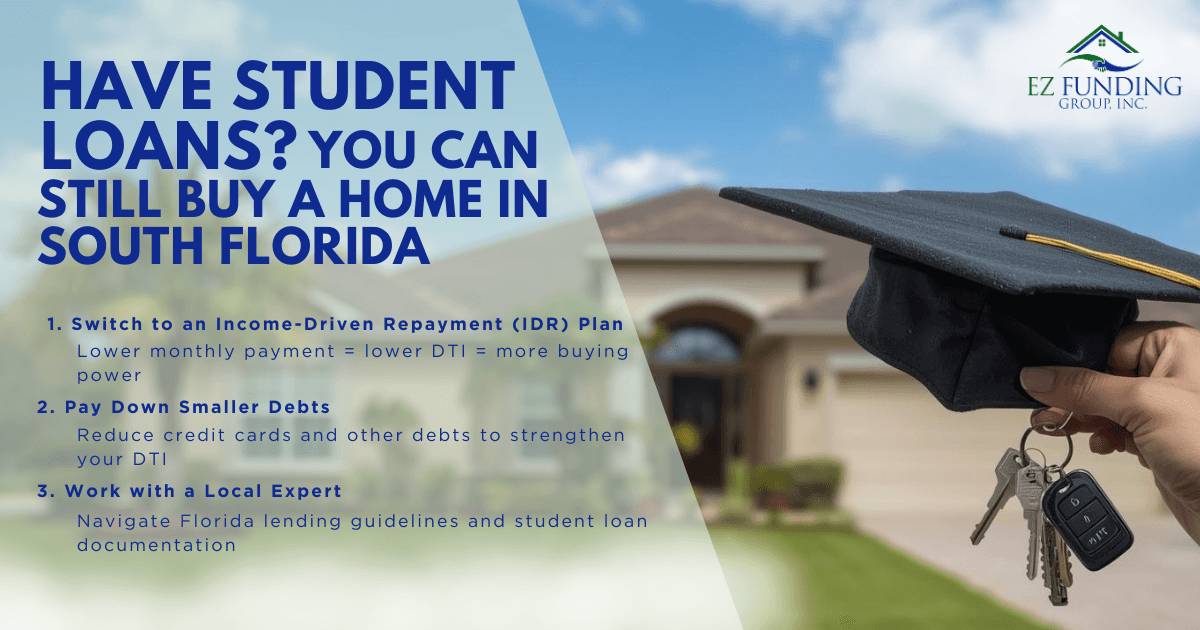

Smart Strategies to Improve Your Mortgage Qualification

Even with student loans, there are proven ways to strengthen your mortgage application in South Florida:

Switch to an IDR plan if your current payment is high. Make sure you document it early so lenders can clearly see the lower payment.

Pay down smaller debts like credit cards to lower your overall DTI.

Increase your income through side work, a raise, or freelance opportunities. Lenders look at your total earnings.

Save for a larger down payment. FHA loans require as little as 3.5% down, but putting down more can improve your loan terms.

Work with a local expert. A Miramar mortgage broker who understands Florida lending guidelines can help you navigate student loan questions and find the right loan for your situation.

Frequently Asked Questions

Can I get an FHA loan in Florida if I have student loans?

Yes! FHA loans are designed to help first-time homebuyers in Florida, and student loans won’t automatically disqualify you. Lenders will consider your student loan payment, and if you’re on an income-driven repayment plan, your qualifying payment could be much lower than you think, helping you qualify for more home.What debt-to-income ratio do I need to buy a home in South Florida?

Most lenders prefer a DTI below 43%. However, FHA loans and other programs may allow higher ratios based on factors like your credit score and down payment. If you reduce your student loan payment through an IDR plan, you can significantly lower your DTI and improve your chances of qualifying.How do I prove my student loan payment to a lender?

Lenders typically require a recent statement or letter from your loan servicer showing your monthly payment amount and payment history. If you're on an IDR plan, make sure the documentation is current, and reflects your reduced payment.

Homeownership is within reach, even with student loans. Whether you're looking in Broward County, Miami-Dade, or Palm Beach, understanding how your repayment plan affects your mortgage application can help you take the next step with confidence.

Don’t let student loans hold you back from homeownership.

Ready to find out exactly how your student loans affect your buying power in South Florida?

Get pre-approved in minutes:Start your application now and see how much home you can afford.

Book a free strategy session:Schedule a call to discuss your unique situation and get personalized mortgage options.

Explore Florida homebuyer programs:Learn about loan options and programs designed specifically for buyers with student loans.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender