Pre-Qualified or Pre-Approved? The Difference Could Cost You a Home in South Florida | EZ Funding Group, Inc.

Pre-qualified vs. pre-approved: Why verified pre-approval wins offers in competitive Florida markets. Get pre-approved in 24-48 hours with EZ Funding Group, Inc.

In Florida’s fast-paced housing market, knowing the difference between being pre-qualified and pre-approved can make or break your offer. One gives you confidence; the other gives you keys. But here's the truth many buyers discover too late: these two terms are not interchangeable and confusing them could mean losing your dream home.

After 20+ years helping Florida families finance homes across Broward, Miami-Dade, Hillsborough, Orange, and Duval Counties, we’ve watched buyers lose dream homes because they showed up with pre-qualification letters instead of verified pre-approvals. In South Florida's fast-moving market, sellers and listing agents can spot the difference instantly. And it changes everything.

What Is Pre-Qualification?

Pre-qualification is a quick, informal estimate of how much you might be able to borrow based on self-reported information. You tell a lender your income, debts, and assets, and they give you a ballpark number usually within minutes.

What it involves:

Based on unverified information you provide

Quick process, often online or over the phone

No credit check in most cases

Gives you a general price range

Takes 5 to 15 minutes

Free

Best for: Getting a rough idea of what you might afford

What Is Pre-Approval?

Pre-approval is a thorough, verified commitment from a lender that you qualify for a specific loan amount based on documented income, assets, credit, and employment.

What it involves:

Requires documentation of income, assets, and credit

Hard credit pull and full credit report review

Income verification (pay stubs, W-2s, tax returns)

Asset verification (bank statements, investment accounts)

Employment verification

Debt-to-income ratio calculation

Provides a specific loan amount and terms

Conditional loan commitment in writing

Timeline: 24 to 48 hours with a responsive lender like EZ Funding Group.

Best for: Making serious offers in competitive markets

That pre-approval letter tells sellers loud and clear: “this buyer is verified and ready to close.”

Think of it this way: A pre-qualification is like telling a seller "I think I can afford your home," while a pre-approval says, "The bank has already verified I can buy your home."

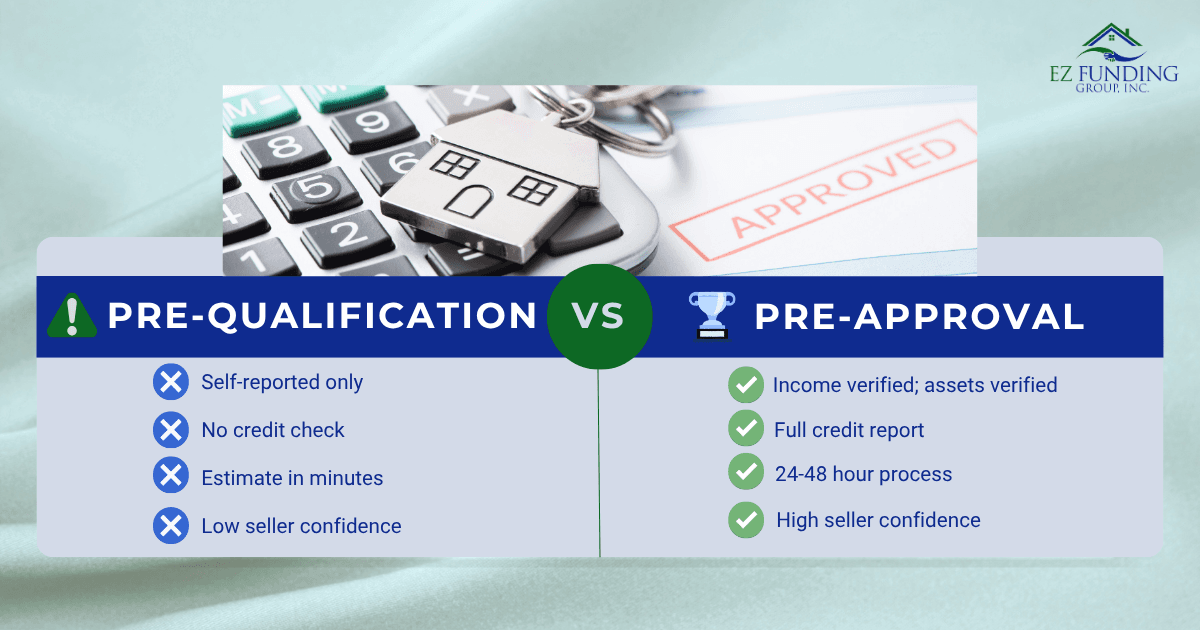

Side-by-Side Comparison

Why Pre-Approval Wins Offers in Competitive Florida Markets

In hot markets across Broward County, Hillsborough County, and Orange County, sellers and their agents see dozens of offers. When they see a verified pre-approval from a reputable lender like EZ Funding Group. Inc, they know:

Your financing is already largely approved

You're a serious buyer who's done their homework

The deal is less likely to fall through due to financing issues

This confidence can be the deciding factor between your offer and someone else's, whether you're buying in Tampa's Hyde Park or Orlando's Lake Nona. An example: a Pembroke Pines seller received three offers on the same day. Two were higher in price, but the seller chose the third buyer who came with a verified pre-approval from EZ Funding Group. Why? Because the seller's agent knew that that buyer could close without financing surprises.

When Pre-Approval Is Non-Negotiable

You MUST have pre-approval if:

Multiple offers — When 3+ buyers are bidding

Hot neighborhoods — Miramar, Weston, Tampa's Hyde Park, Orlando's Lake Nona

New construction — Builders in Tampa, Orlando, Miami-Dade require it

Move-up buyers — Sellers need certainty to coordinate their next purchase

Fast closings — Seller wants to close in 30-45 days

How to Get Pre-Approved (The Right Way)

Before you start touring homes in Hollywood, Tampa, or Jacksonville, take these steps to get pre-approved with EZ Funding Group, Inc.:

Total time investment: ~30 minutes of your time + 24-48 hours for our review

Step 1: Gather Your Documents(10 minutes)

Last 2 years of W-2s or tax returns (self-employed)

Last 2 months of pay stubs

Last 2 months of bank statements

Photo ID

List of current debts (credit cards, car loans, student loans)

Step 2: Apply Online or Schedule a Call(10-15 minutes)

Start your pre-approval online or book a 15-minute call to discuss your situation.

Step 3: Credit and Income Review(24-48 hours; we do the work)

We'll pull your credit, verify your income and assets, and calculate your debt-to-income ratio.

Step 4: Receive Your Pre-Approval Letter(Same day once approved)

Within 24 to 48 hours, you'll have a verified pre-approval letter to submit with your offers.

Common Questions

Does pre-approval hurt my credit score?

Yes, but minimally (3-5 points), and it's worth it. Pre-approval requires a hard credit inquiry, which may temporarily lower your score by 3 to 5 points. However, multiple mortgage inquiries within a 45-day window count as a single inquiry, so you can shop lenders without additional impact. Bottom line: The temporary dip is far outweighed by the competitive advantage you gain.

How long is a pre-approval good for?

Most pre-approvals are valid for 60 to 90 days. After that, lenders will need updated documents and a refreshed credit report.

Can I get pre-approved if I'm self-employed?

Absolutely! Self-employed buyers in Tampa, Orlando, Jacksonville, and across Florida qualify every day using tax returns, bank statements, or Non-QM loan programs. We specialize in helping self-employed buyers navigate the documentation process.

What if I don't have 20% down?

You don't need 20% down! FHA loans require just 3.5% down, conventional loans can go as low as 3%, and VA loans require 0% down for eligible veterans. Learn more about Florida down payment options here.

Ready to Get Pre-Approved?

Don't let a weak pre-qualification letter cost you your dream home. Get verified, get confident, and get ready to make competitive offers across Florida.

Next steps:

Start your pre-approval: Apply online in 10 minutes

Have questions first? Schedule a quick 15-minute call

Explore your loan options: Review Florida mortgage programs

If you're thinking about buying or refinancing in South Florida or anywhere across Tampa, Orlando, Jacksonville, and beyond, reach out today to explore your best options. Let's turn your homeownership goals into a verified, competitive offer that sellers take seriously.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender