Florida Property Insurance Guide: What Every Buyer Should Know in 2025

In Florida's ever-changing insurance market, understanding how your policy works can make all the difference between a smooth closing and an unexpected setback. Whether you're buying your first home or navigating a competitive offer situation, knowing what drives your premium—and which homes will be easier to insure—gives you a powerful advantage.

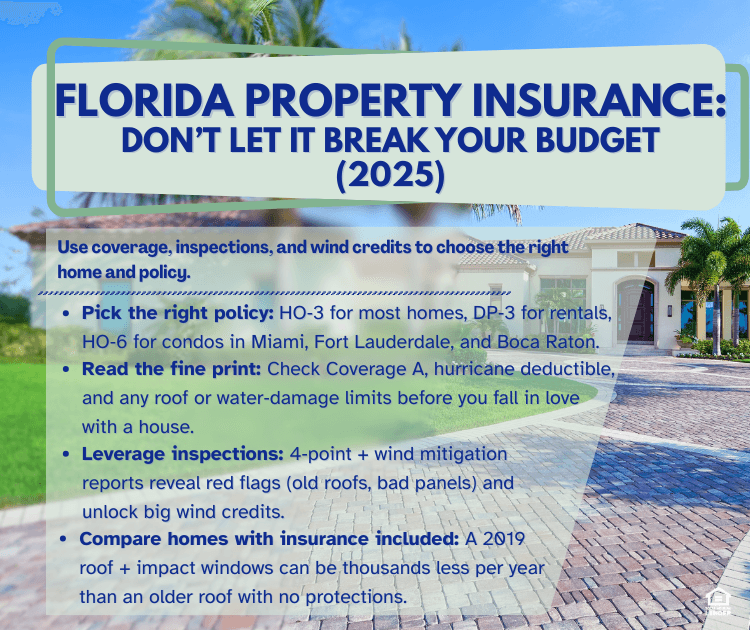

Insurance can make or break a deal, especially in Florida, where premiums vary drastically based on the roof, wind protections, and inspection results. In Miramar, Pembroke Pines, Hollywood, Weston, Davie, Plantation, and across Broward, Miami-Dade, and Palm Beach, smart buyers use coverage choices, inspection reports, and wind mitigation together to decide which homes are truly worth pursuing and lock in better long-term insurance costs. This is about how the policy is built, not just "why it's expensive."

1. Start With the Right Policy Type

The policy type shapes what's covered and how claims are paid.

HO-3: Standard for Florida Homes

Common for single-family homes and townhomes in Miramar, Pembroke Pines, Hollywood, Weston, Cooper City, Davie.

Covers:

Dwelling (structure)

Personal property (belongings)

Liability

Loss of use

When comparing quotes, check:

Coverage A vs rebuild cost

Hurricane deductible (often 2–5% of Coverage A)

Roof or water-damage limitations

DP-3: Rentals and Non-Standard Cases

Used for rentals or homes that don't meet HO-3 guidelines. Focuses on structure over contents, with different exclusions and deductibles.

Condos: HO-6

For condos in Hollywood, Miami, Fort Lauderdale, West Palm Beach, Boca Raton:

Association's master policy covers building shell

Your HO-6 covers interior, belongings, liability

Key questions:

Where does master policy end?

What's the hurricane deductible?

Do you have loss assessment coverage?

2. Use Inspections as an Insurance Planning Tool

Florida insurers rely on inspection reports to decide coverage terms.

4-Point Inspections

Required on older homes. Focuses on roof, electrical, plumbing, HVAC.

Red flags:

Federal Pacific or Zinsco panels

Polybutylene pipes

Roofs older than 20 years

Flat roofs

The 4-point report shows which homes are easier and cheaper to insure.

Wind Mitigation Credits

Big savings hide here—especially in Miami-Dade with impact windows.

Records:

Roof shape and attachment

Roof age

Opening protections (impact windows, shutters)

Insurers apply wind mitigation credits that dramatically lower premiums.

3. Key Coverage Choices

Replacement Cost vs ACV

Replacement cost: Pays to repair/replace (up to limits)

ACV: Replacement cost minus depreciation

Ask:

Is my roof on replacement cost or ACV?

Are there limitations on roof claims?

Hurricane Deductibles

Often a percentage of Coverage A:

5% deductible on $400K home = $20,000 out of pocket

Match your deductible to your emergency fund.

4. Turn Insurance Into a Home-Selection Filter

Use insurance as a decision tool while shopping:

Compare inspection reports + wind mitigation + roof age

Have your agent price different homes

Example (estimated sample premiums):

Home A: 2019 roof, impact windows → ~$3,500/year

Home B: 2003 roof, no protection → ~$6,800/year + required upgrades

Over 5 years: $16,500+ in extra costs.

Curious what your inspection report means for your insurance rate? Let's review it together.

Frequently Asked Questions

What is the average cost of home insurance in Broward County in 2025?

Premiums typically range from $3,500 to $8,000+ annually, depending on roof age, wind mitigation features, and home value.

Does wind mitigation really lower premiums in South Florida?

Yes. Homes with impact windows, reinforced doors, and newer roofs can see premium reductions of 20–40% or more.

Which homes are hardest to insure in Florida?

Homes with roofs older than 20 years, Federal Pacific or Zinsco panels, polybutylene plumbing, or flat roofs often face coverage denials or require costly repairs before insurers will bind a policy.

Don't let insurance derail your Florida home search. Let's compare properties and premiums side-by-side before you make an offer. If you're navigating a competitive market, you may also want to read how to compete with investors and cash offers in South Florida.

Get pre-approved in minutes: Start your application now

Explore Florida homebuyer programs: Learn about low-down-payment and first-time buyer options

Book a strategy call: Schedule a call to review homes, inspections, and insurance scenarios together

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender