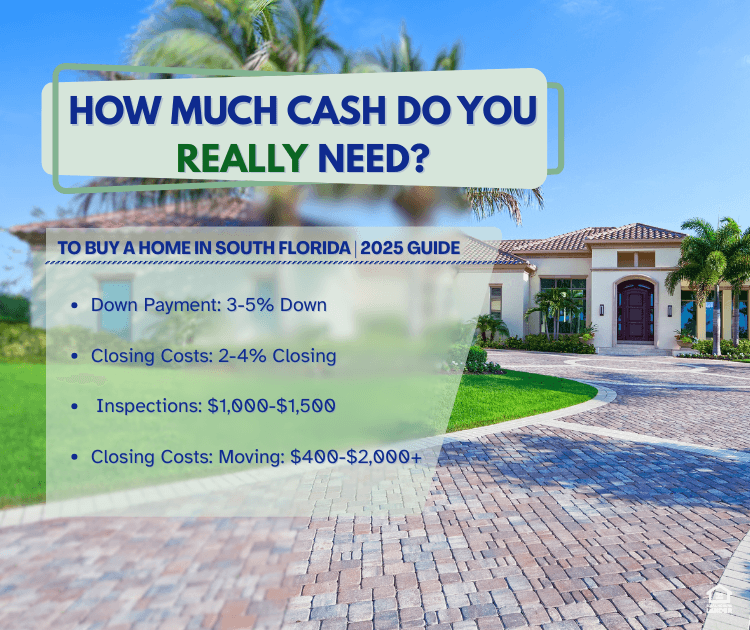

How Much Cash Do You Really Need to Buy a Home in Florida?

Buying a home in Florida? Learn how much cash you really need for down payment, closing costs, inspections, and moving expenses in South Florida and beyond.

Down Payment, Closing Costs & Cash-to-Close Guide for 2025–2026

Quick Answer:

Most Florida homebuyers need about 7%–10% of the purchase price in upfront cash, including down payment, closing costs, inspections, and moving expenses. On a $400,000 Florida home, that's typically $28,000–$40,000. Many buyers qualify for programs that reduce this even further.

Buying a home in Florida, especially in South Florida, Orlando, Jacksonville, Tampa, and surrounding counties, means understanding exactly how much cash you'll need upfront. Between the down payment, closing costs, inspections, and other fees, the numbers can feel overwhelming.

The good news though, is that most buyers are surprised that they actually need less cash than they expected.

As a local South Florida mortgage broker serving Miramar, Pembroke Pines, Weston, Hollywood, Miami-Dade, Broward, and Palm Beach, here's a clear and simple guide to what you should prepare for in 2025.

To explore programs that reduce upfront costs, see our guides to FHA loans in Florida, first-time buyer options, and Florida down payment assistance programs on our main site.

If you're comparing FHA vs conventional or down payment options, you can start your pre-approval here.

1. Down Payment: 3%–20%

Your down payment depends on your loan type:

FHA Loans: 3.5% down

Conventional Loans: 3%–5% down for first-time buyers

VA / USDA Loans: 0% down (if eligible)

Jumbo Loans: 10%–20% down

Example at a $450,000 Florida Home

FHA (3.5%): $15,750

Conventional (5%): $22,500

VA/USDA: $0

Most of the buyers I help in Broward and Miami-Dade use 3%–6% down, not 20%.

2. Closing Costs: 2%–4%

These include lender fees, title work, escrows, taxes, and insurance.

Typical Closing Costs in Florida

$350,000 home: $7,000–$14,000

$450,000 home: $9,000–$18,000

$600,000 home: $12,000–$24,000

Florida's rising homeowners insurance can make escrows higher in areas like Miami, Fort Lauderdale, and coastal cities. Insurance escrows in Miami-Dade average higher due to wind premiums, while Palm Beach County properties may require higher escrows due to insurance premiums.

3. Inspection, Appraisal & Upfront Fees: $1,000–$1,500

These are paid during the process, before closing.

Home inspection: $300–$500

Wind mitigation / 4-point: $100–$200

Appraisal: $500–$700

Older homes in Hollywood, Fort Lauderdale, and Miami neighborhoods may require extra inspections. Average inspection costs are slightly higher in Miami-Dade, and Broward appraisals may vary from Palm Beach County.

4. Moving & Initial Expenses: $400–$2,000+

Local moves typically range from $400–$1,000.

Longer moves may exceed $1,500+.

Buyers often budget for paint, locks, appliances, and first-month HOA dues.

What Affects Your Total Cash-to-Close?

Several factors can increase or decrease the cash you need to bring to closing:

Seller credits: Sellers may agree to cover part of your closing costs, reducing your upfront cash.

Down payment assistance programs: Florida offers programs like Hometown Heroes and county-specific grants.

Loan type: FHA loans require less down but include mortgage insurance.

Home price and location: Higher-priced homes and coastal areas often have higher insurance and escrow requirements.

Builder incentives: New construction may come with closing cost credits or rate buydowns.

Understanding these factors helps you plan more accurately and potentially save thousands.

Estimated Cash to Close by Home Price

$350,000 Home

Down payment (3%): $10,500

Closing costs: $7,000–$14,000

Inspections/Appraisal: $1,000–$1,200Estimated total:$18,500–$25,700

$450,000 Home

Down payment (3%): $13,500

Closing costs: $9,000–$18,000

Inspections/Appraisal: $1,200–$1,500Estimated total:$23,700–$33,000

$600,000 Home

Down payment (3%): $18,000

Closing costs: $12,000–$24,000

Inspections/Appraisal: $1,200–$1,500Estimated total:$31,200–$43,500

Remember: Florida down payment assistance, seller credits, and builder incentives can reduce these numbers significantly.

Local Comparison: Cash-to-Close by County

Areas like Miami Gardens and Hialeah often have lower purchase prices but higher insurance deductions, while Palm Beach County properties may require higher escrows due to insurance premiums.

Florida-Specific Savings & Programs

Many Florida buyers, especially in Broward, Miami-Dade, and Palm Beach — qualify for programs such as:

Florida Hometown Heroes

County and city assistance programs

Bond programs

Employer-based housing credits

Seller-paid closing costs

Builder incentives on new construction

These can reduce your cash-to-close by thousands.

FAQ: Cash-to-Close for Florida Homebuyers

Will my property taxes be the same as the current owner's?

Probably not. When you buy, the county can reassess the value closer to your purchase price, which may increase the bill. Your Homestead Exemption can help once it kicks in for your primary residence.

Can seller credits cover all closing costs in Florida?

Yes, in many cases. Depending on your loan type, sellers can contribute 3%–6% of the purchase price toward your closing costs, which can significantly reduce or even eliminate your out-of-pocket costs at closing.

Is it cheaper to buy in Broward or Miami-Dade?

Generally, Broward County offers more affordable options than Miami-Dade, with lower average home prices and insurance costs. However, specific neighborhoods vary widely.

How much cash do first-time buyers usually bring to closing?

Most first-time buyers in Florida bring between $15,000–$30,000 to closing, depending on the home price and whether they use down payment assistance or seller credits.

Can I estimate my total cash-to-close before I make an offer?

Yes. Your lender and real estate agent can provide a detailed estimate based on your purchase price, loan type, and local costs so you know exactly what to expect.

What factors affect my cash-to-close amount?

Your loan type, down payment percentage, seller credits, insurance costs, property taxes, and any down payment assistance programs you qualify for all affect your total cash-to-close.

Final Takeaway

Most Florida buyers are surprised to learn they don't need 20% down. Buyers in Miramar, Pembroke Pines, Weston, Hollywood, Miami, Fort Lauderdale, and West Palm Beach often purchase homes with 3%–6% down plus seller credits to lower closing costs.

Once you understand your true cash requirements, and the Florida programs available, the path to homeownership becomes much clearer.

Ready to See Your Real Numbers?

Apply online: Schedule your application

Explore Florida buyer programs: Learn about low down payment options

Book a strategy call: Schedule a consultation

If you're thinking about buying or refinancing in South Florida, reach out today to explore your best options.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender