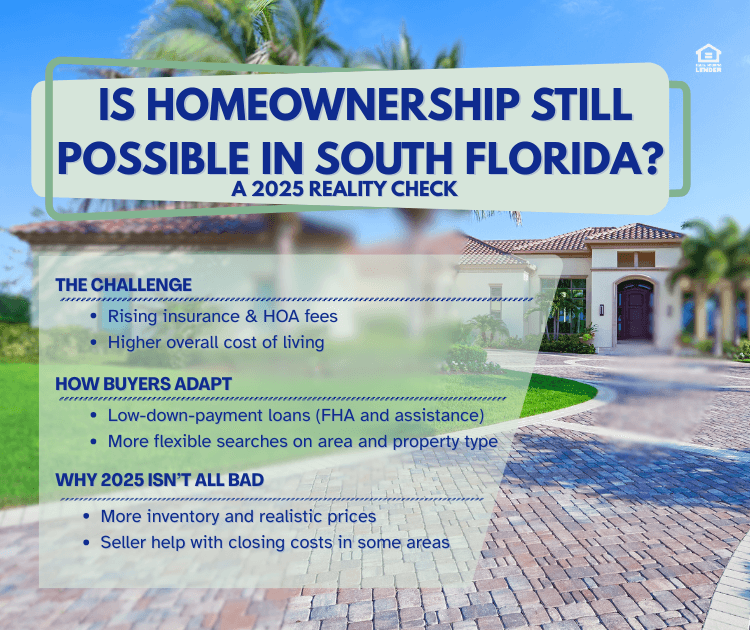

Is Homeownership Still Possible in South Florida? A 2025 Reality Check

Is buying a home in South Florida still possible in 2025? Discover what’s changed, and how smart strategies and flexible programs are helping buyers succeed.

If you’ve been searching for homes in Miramar, Pembroke Pines, Hollywood, Weston, Miami, or anywhere across South Florida, you’ve probably wondered: “Is buying a home here still realistic?”

The short answer: Yes, but the path looks different in 2025.

Rising insurance costs, higher living expenses, and elevated home prices continue to challenge buyers, but improved inventory, flexible loan programs, and smarter strategies are helping more residents become homeowners this year.

Whether you're a first-time buyer or planning your next move, here’s the clear, honest look at what’s happening, and how people are still successfully buying homes in South Florida.

Affordability: What 2025 Buyers Are Facing

South Florida remains one of the most desirable, and therefore, expensive regions in the country. Beyond the listed home price, buyers must factor in:

Insurance premiums

Property taxes

HOA/condo fees

Utilities and maintenance

These real-world expenses impact monthly affordability more than buyers expect. While wages in major employment hubs like Fort Lauderdale, Miami, and West Palm Beach have grown, they haven’t fully kept pace with the combined rise in housing and lifestyle costs.

How buyers are adapting:

Using low-down-payment options such as FHA

Leveraging county and state assistance programs

Expanding searches into more affordable neighborhoods

Choosing condos/townhomes instead of single-family homes

Buying with a co-borrower to strengthen overall qualifying power

Homeownership is still possible, but strategy matters more than ever.

Inventory: More Choices, Less Frenzy

The pandemic-era bidding wars are long gone.

In 2025, South Florida buyers are benefiting from:

Higher inventory in Broward, Palm Beach, and parts of Miami-Dade

More realistic list prices

Sellers offering concessions or closing cost help

Less extreme competition

Neighborhoods like Miramar, Hollywood, Lake Worth, and Sunrise often offer more balanced pricing and supply, giving buyers room to compare homes, negotiate, and think clearly, which was almost impossible in 2021–2022.

This stabilized environment is creating real opportunities for prepared buyers.

Wage Growth vs. Living Costs: The Real Gap

The challenge for many South Florida residents isn’t income; it’s the pace of rising expenses. Insurance increases, HOA fees, and overall living costs continue to impact affordability.

Instead of giving up, buyers are shifting their expectations:

Looking at emerging neighborhoods

Prioritizing value over proximity to high-priced hotspots

Exploring multi-unit or “house hacking” strategies

Choosing homes that offer room for long-term financial growth

With clear expectations, buyers are finding homes that match both their budgets and their goals.

So… Is Homeownership Still Possible?

Absolutely, and thousands of South Floridians are still closing on homes every month.

Here’s how today’s successful buyers approach the market:

They get fully pre-approved before shopping

They stay open to different property types and locations

They use assistance programs when available

They work closely with a trusted local mortgage expert

They make decisions based on total monthly costs not guesswork

A home in Pembroke Pines, Plantation, or Lake Worth may not be waterfront, but it can offer stability, comfort, and long-term equity.

Your path may look different than buyers five years ago, but it’s still a real, attainable path.

Ready to Start Your Homeownership Plan?

If you're considering buying in South Florida, the best first step is understanding your options clearly and confidently.

Apply Online: Start your application now

See Buyer Programs: Explore Florida homebuyer programs

Book a Strategy Call: Schedule a call

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender