Pending Home Sales Are Up: What This Means for Florida Homebuyers in 2026

Pending home sales are up and rates are stabilizing. See what this means for Florida first-time homebuyers in 2026 and how to plan your next move.

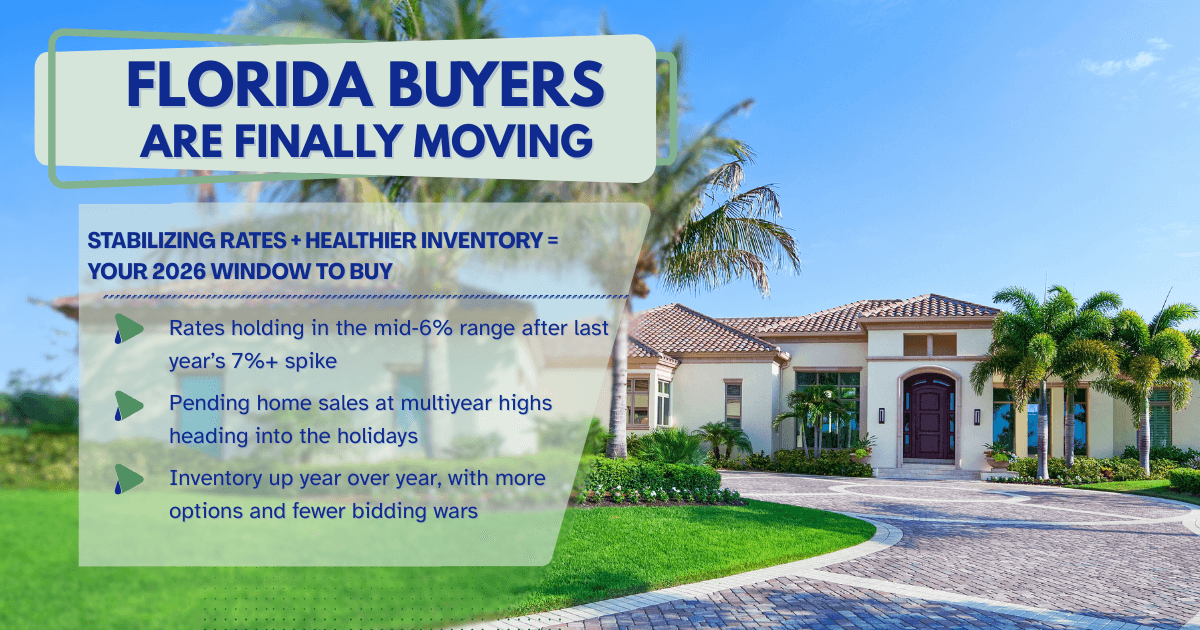

If you've been waiting for a sign that it might finally be your moment to buy in Florida, the latest pending home sales data is a step in the right direction. According to recent HousingWire analysis, pending home sales have reached a multiyear high for this time of year, and purchase applications have shown strong year-over-year growth even as we head into the holiday season.

For buyers in South Florida and across the state from Miramar, Pembroke Pines, and Hollywood to Orlando, Tampa, and Jacksonville, this tells us that buyers are adjusting to today's mortgage rates and getting off the fence.

Rates Are Stabilizing, and Buyers Are Moving

HousingWire's market tracker shows that mortgage rates have stayed below about 6.64% for several weeks, with 30-year fixed rates hovering in the mid-6% range. While this isn't the record-low environment of 2020–2021, it's a welcome shift from the 7%+ spike that paused so many Florida homebuyers.

For a Florida first-time homebuyer, this matters because:

Stabilizing rates make it easier to plan your budget.

Lenders can better qualify you for programs like FHA loans Florida and low-down-payment conventional options.

More buyers are comfortable locking in today's rates instead of "waiting for 5%" and risking higher prices or tighter competition later.

If you're shopping in Broward County (Miramar, Weston, Plantation), Miami-Dade (Miami, Doral, Hialeah), Palm Beach County, or even major metros like Orlando, Tampa, and Jacksonville, this shift means the market is active, but not as frantic as the peak pandemic years.

Inventory Is Healthier, But Still Seasonal

The same report notes that total housing inventory is still up year over year, even though it's following the normal seasonal dip heading into the holidays. More homes on the market gives buyers:

More neighborhoods and price points to explore

Fewer bidding wars and more realistic seller expectations

Better opportunities for closing cost credits or repair negotiations

In Broward County, for example, inventory is up compared to last year, giving first-time buyers a better shot at negotiation. In practical terms, this might look like:

A budget-friendly townhome in Miramar or Pembroke Pines

A single-family home farther west in Broward

More affordable starter homes in Orlando, Tampa, or Jacksonville compared to Miami's urban core

Working with a South Florida mortgage broker who knows these markets can help you line up the right financing before the best homes hit your radar.

What This Means for You as a Florida Buyer

Here's how to make this data work in your favor:

Know your buying power in today's rate environment. Use today's rates, not last year's, to see what payment fits your budget.

Explore FHA and low-down options. Many Florida first-time homebuyers use FHA loans Florida with as little as 3.5% down, paired with local assistance when available.

Be flexible on location. Neighborhoods in Miramar, Hollywood, Sunrise, Lake Worth, Orlando, Tampa, and Jacksonville can offer strong value without giving up lifestyle.

Move when the right home appears. With pending sales rising, the best-priced homes still go first.

Ready to Plan Your 2026 Home Purchase?

Whether you're buying your first home or upgrading to your dream property, the 2026 market could be your window of opportunity, and we're here to help you make the most of it.

The best first step is understanding your real numbers and available programs.

Get pre-approved in minutes: Start your application

Book a free consultation: Schedule a call

Explore low-down programs: Learn about FHA and low-down-payment options

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender