Property Taxes in South Florida: What Buyers Need to Know Before Closing

Learn how South Florida property taxes work and how they impact your mortgage payment. Discover Homestead Exemption benefits and county-by-county insights before closing.

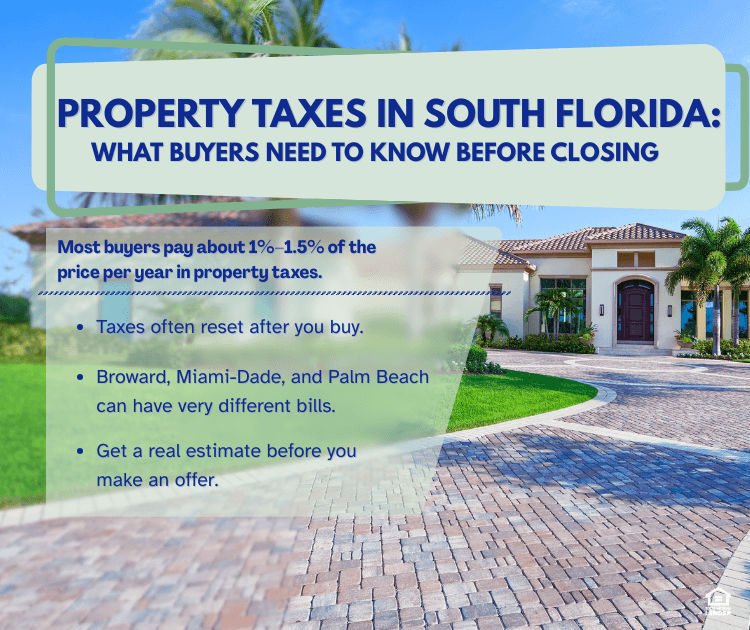

Quick Answer: Property taxes in South Florida are based on your home's assessed value and local tax rates. Most buyers can expect to pay around 1%–1.5% of the purchase price per year, but primary homeowners may lower their bill with the Florida Homestead Exemption and the Save Our Homes cap, which help keep long-term tax increases in check.

In South Florida, property taxes can impact your monthly payment just as much as insurance and HOA fees. Whether you're buying in Broward, Miami-Dade, or Palm Beach, understanding how taxes are calculated and how they reset when you buy can help you avoid surprises at closing. For many buyers, seeing how taxes reset after closing can be an eye-opener but with the right planning, it doesn’t have to be overwhelming.

As a South Florida mortgage broker serving buyers across Broward, Miami-Dade, Palm Beach, and the rest of Florida, we walk clients through taxes the same way we do insurance and closing costs. If you're a Florida first-time homebuyer, this is just as important as choosing between FHA loans Florida, conventional, or VA financing.

For a deeper dive into first-time buyer strategies and down payment options, make sure to read our guides on FHA, low-down-payment loans, and Florida homebuyer assistance programs on our main site.

How Property Taxes Work in Florida

Florida doesn't have a state income tax, so property taxes are a major way local governments fund schools, roads, and services. Here's the basic formula:

The county appraiser determines your home's assessed value.

Local governments set a millage rate (your tax rate).

Your property tax bill = (assessed value – exemptions) × millage rate.

Because millage rates vary by county, city, and even special districts, two similar homes can have very different tax bills depending on whether they're in Broward, Miami-Dade, Palm Beach, Orlando, Tampa, or Jacksonville.

For example, a home in Miramar (Broward) may have a different total tax rate than a similar home in Kendall (Miami-Dade) or Lake Worth (Palm Beach County) once city and school taxes are added in.

How Property Taxes Affect Your Monthly Payment

Buyers often focus on interest rates, but property taxes directly impact what you pay each month:

Taxes are escrowed: Your lender collects a portion of your annual tax bill every month and pays it on your behalf, so your monthly payment rises or falls with them.

Higher taxes reduce buying power: When taxes increase, your total monthly payment goes up, which can affect how much home you qualify for.

Property type matters: Condos vs. single-family homes may have different tax burdens depending on assessed values and special assessments.

This is why, when we run numbers for a Miramar mortgage or Broward home loans, we always look at total housing cost: principal, interest, taxes, and insurance.

Broward vs. Miami-Dade vs. Palm Beach Property Taxes: What Buyers Should Know

Exact tax rates change year to year, but here's what many buyers notice when comparing South Florida counties:

Broward County (Miramar, Pembroke Pines, Weston, Plantation): Most predictable tax structure, though often moderate to higher tax bills, especially in HOA and master-planned communities where additional assessments or CDD fees may apply.

Miami-Dade County (Miami, Doral, Hialeah, Homestead): Urban areas tend to have some of the highest total tax bills in the region thanks to higher property values and additional city or special district taxes.

Palm Beach County (Lake Worth, Wellington, Boynton Beach, West Palm Beach): A mix of higher-value coastal zones and more affordable inland neighborhoods. Inland communities often provide some of the most tax-efficient options in South Florida.

Buyers considering other parts of Florida, like Orlando (Orange County), Tampa (Hillsborough County), or Jacksonville (Duval County), often find that overall tax burdens can be lower than in the tri-county South Florida area, even at similar price points.

Homestead Exemption and Save Our Homes for Florida Buyers

If you're buying a primary residence anywhere in Florida, the Florida Homestead Exemption and Save Our Homes cap can be powerful tools:

The Homestead Exemption reduces your taxable value (often by up to $50,000 on many homes), which lowers your annual bill.

The Save Our Homes cap limits how much your assessed value can increase each year, even if market values jump.

Over time, especially in appreciating areas like Weston, Pembroke Pines, Miami, and Palm Beach Gardens, this can create a big gap between what your home is worth and what you're taxed on.

One common mistake: New buyers see the seller's current tax bill online and assume theirs will be similar. In reality, your taxes can reset based on your new purchase price, which may be much higher than the seller's old assessed value.

When we pre-approve buyers, we use realistic county-specific estimates, not just the old number on a listing.

FAQ: Property Taxes for Florida Homebuyers

Will my property taxes be the same as the current owner's?

Probably not. When you buy, the county can reassess the value closer to your purchase price, which may increase the bill. Your Homestead Exemption can help once it kicks in for your primary residence.

Are property taxes higher in South Florida than the rest of Florida?

In many cases, yes, especially in high-demand areas of Broward, Miami-Dade, and Palm Beach Counties. However, some buyers find lower total taxes in markets like Orlando, Tampa, Jacksonville, or Port St. Lucie while still staying in Florida.

Can I estimate my taxes before I make an offer?

Yes. Your lender and real estate agent can help you plug your estimated purchase price into county tax calculators so you see a realistic yearly and monthly estimate before you go under contract.

Next Steps: Plan Your Budget Before You Close

Property taxes are just one piece of the puzzle, but they play a big role in your comfort level with a payment whether you're buying in South Florida or anywhere else in the state.

Here's how to move forward confidently:

Ask for a custom payment estimate that includes realistic taxes, insurance, and HOA costs.

Confirm whether the property will be your primary residence so you can plan for Homestead Exemption.

Compare total payments for homes in Broward, Miami-Dade, Palm Beach, and other Florida counties you're considering.

Choose a loan program, such as FHA loans Florida or conventional, that gives you room in your budget for changing taxes and insurance over time.

If you're thinking about buying or refinancing in Florida, whether in Broward, Miami-Dade, Palm Beach, or beyond, here's how to move forward:

Explore our guides on FHA loans, down payment options, and Florida homebuyer assistance programs.

Apply now for pre-approval to get started with your home purchase.

Schedule a call to discuss your best options and get personalized guidance.

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender