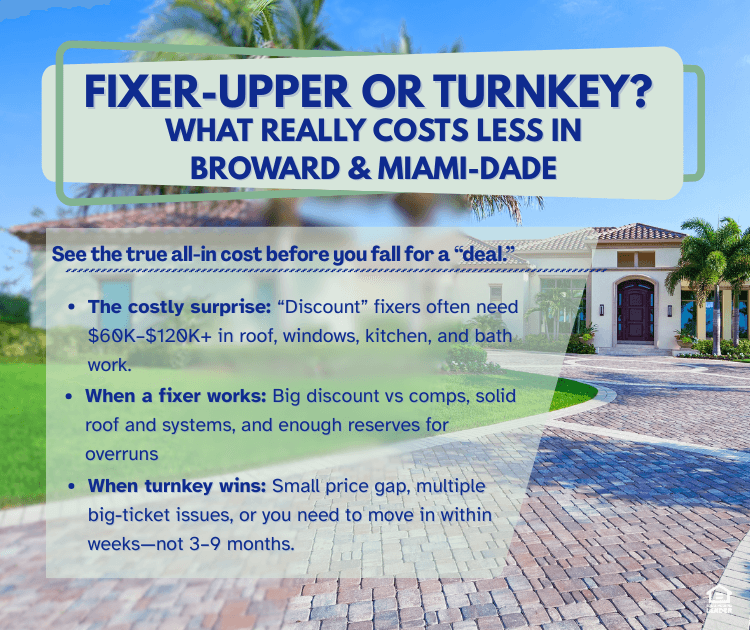

Fixer-Upper or Turnkey? What Really Costs Less in Broward & Miami-Dade

The costly mistake: Buyers in Broward and Miami-Dade often choose a fixer-upper because the list price is lower, then discover their "deal" costs $60,000–$120,000+ more than expected. That discounted home can end up more expensive than buying turnkey. This guide shows you the real all-in cost of both paths, so you can decide with confidence.

Why Most South Florida "Deals" Don't Pencil Out

On paper, that dated home in Miramar, Pembroke Pines, or Hollywood looks like a steal: $40,000–$80,000 below move-in ready comps. You picture fresh paint, new floors, and a modern kitchen.

But South Florida's climate and market reveal hidden costs:

Humidity damage and past water leaks

Older roofs that won't pass insurance requirements

Outdated electrical panels or plumbing that fail 4-point inspections

HOA restrictions and permit delays that stretch timelines

The real question isn't "Can I fix it up?" but "Will I still be ahead after everything is done?"

Real Renovation Costs in Broward and Miami-Dade

Local contractors typically quote:

Roof replacement: $18,000–$35,000+

Impact windows/doors: $18,000–$40,000+ for a single-family home

Kitchen remodel (mid-range): $20,000–$40,000

Two bathroom updates: $8,000–$15,000 each

Full interior paint and flooring: $10,000–$25,000

Add permits, inspections, and a 10–20% contingency buffer, and a "cosmetic update" easily reaches $60,000–$120,000+.

Contractor realities: In Pembroke Pines, Miami Gardens, and Weston, expect longer contractor wait times, especially after storm season.

Fixer vs Turnkey: Quick Comparison

When a Fixer-Upper Actually Saves You Money

A South Florida fixer makes sense when:

The discount is significant: Turnkey homes in the area sell for $550K, the fixer lists at $430K, and realistic repairs total $80K–$90K, leaving you at or below market with a customized home

Major systems are solid: Roof, structure, plumbing, and electrical are intact; you're doing cosmetic or mid-level updates

You have reserves: Beyond down payment and closing costs, you can handle surprises

You're staying long-term: You'll benefit from appreciation and recoup renovation costs

Real example: A young couple in Pembroke Pines found a fixer listed at $425K (turnkey comps at $540K). The inspection showed a solid roof and good bones—just outdated cosmetics. They invested $65K in kitchen, bathrooms, and flooring, bringing their all-in cost to $490K. After completion, their home appraised at $545K, giving them $55K in instant equity while getting exactly the finishes they wanted.

It's less attractive when:

The price gap vs turnkey is narrow ($20K–$30K)

You're stretched financially with little left for repairs

The inspection reveals multiple high-ticket items (roof + electrical + plumbing + A/C + windows)

In those cases, a slightly pricier turnkey or light-update home in Broward or Miami-Dade wins on true cost and stress.

Your Fixer-Upper Decision Checklist

Before you commit, answer these:

Cash: After down payment and closing, how much do I have for renovations plus emergency savings?

Time: Can I manage 3–9 months of construction, or do I need to move in now?

Risk tolerance: Am I comfortable if contractor bids come back 20% higher?

Exit strategy: If I sell in 3–5 years, will I recoup what I invested in this neighborhood?

Run side-by-side scenarios: Compare a fixer in Hollywood or Miramar against a turnkey home in Pembroke Pines or Weston. Once you see the all-in cost, timeline, and stress level for each, the right choice becomes clear.

Bottom Line

In South Florida's market, a lower list price doesn't guarantee savings. Between high renovation costs, contractor delays, and insurance hurdles, many fixer-uppers end up costing more than turnkey homes, while adding months of stress.

The smartest move? Run real numbers before you commit.

This information is for educational purposes only and should not be considered financial advice. Actual renovation costs, loan qualification requirements, and potential savings will vary based on your specific situation, credit profile, and market conditions. Consult with a licensed mortgage professional and qualified contractor before making any purchase decisions.

Ready to Compare Fixer vs Turnkey for Your Budget?

Get pre-approved in minutes: Start your application now

Explore renovation and first-time buyer programs: See your Florida options

Book a strategy call: Let's run fixer vs turnkey scenarios for your situation

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender