New Construction Homes in South Florida: What to Expect in 2025

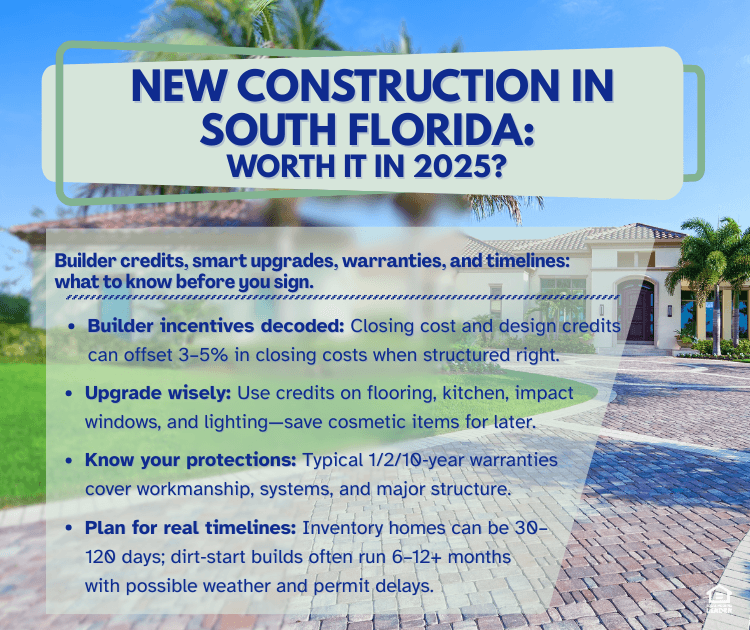

Is new construction worth it in 2025? For buyers in Broward and Miami-Dade, the answer depends less on flashy ads and more on understanding builder incentives, smart upgrades, warranty coverage, realistic timelines, and total costs. When you know how South Florida builder incentives work and what delays construction, you can get more value without closing-day surprises.

New Construction vs Resale: Key Differences in Florida

Before diving into builder credits and timelines, here's what makes new construction different from resale homes in South Florida:

Warranties: 1/2/10-year coverage vs as-is condition

Customization: Choose finishes and layouts upfront

Energy efficiency: Modern windows, insulation, and HVAC

Timeline: 30 days to 12+ months vs 30–45 days typical closing

Negotiation: Credits and upgrades vs price reductions

What this means for you: New construction offers predictability and modern features, but requires patience and careful cost tracking.

Builder Incentives Explained: What's Really Included?

Most major builders in Miramar, Pembroke Pines, Hollywood, Weston, Doral, Miami Gardens, and Homestead, including Lennar, DR Horton, Pulte, GL Homes, and CC Homes offer incentives. But not all incentives are equal.

Common South Florida builder incentives:

Closing cost credits ($5,000–$15,000 typical) toward title, prepaid taxes, insurance, or lender fees

Design center credits ($3,000–$10,000+) for flooring, cabinets, counters, or appliances

Lot premium discounts or reduced pricing on structural options (covered patio, extra bedroom)

Smart approach:

Ask for a written breakdown of base price, options, and each credit

Compare deals across nearby Broward and Miami-Dade communities to ensure the "discount" isn't inflated pricing

Prioritize incentives that reduce cash to close or cover upgrades hard to change later

Real example: Many Pembroke Pines buyers use $7,000–$10,000 in builder credits to cover closing costs, lowering their upfront cash need significantly. Learn more about typical closing costs in South Florida.

Design Upgrades: What's Worth It?

Design centers make it easy to overspend. Focus on upgrades that add value or are expensive to change later.

Worth doing with the builder:

Durable flooring (tile or LVP, typically $3,000–$8,000)

Kitchen upgrades: cabinets, quartz countertops, backsplash ($5,000–$12,000)

Impact windows/doors if not standard ($8,000–$15,000) — these can also lower your insurance premiums. See how impact-rated features affect Florida home insurance.

Extra lighting and outlets ($500–$2,000)

Save for later:

Light fixtures and ceiling fans

Accent walls and cosmetic finishes

Closet systems

Rule of thumb: Use builder credits on structural or messy upgrades. Save cosmetic projects for after closing.

What New Construction Really Costs in South Florida

Pricing varies by location and builder, but here are typical 2025 ranges:

Townhomes: Mid-$400s to mid-$500s in Broward and Miami-Dade

Single-family homes: $600s+ depending on location and lot size

Upgrade costs:$10,000–$30,000 average at design center

Lot premiums:$5,000–$25,000 for corner, water, or cul-de-sac lots

HOA fees:$150–$400/month typical, some with CDD fees adding $100–$200/month

New construction closing costs vs resale: Often 3–5% of purchase price, but builder credits can reduce this significantly. Learn more about low-down-payment options that can help you buy new construction with less upfront cash.

Warranties: What's Covered?

Florida's climate demands strong warranty protection. Typical new construction warranty structure:

1-year workmanship/materials – drywall, paint, minor items

2-year systems – electrical, plumbing, HVAC

10-year structural – foundation, major structural components

Questions to ask every builder:

Who provides the 10-year structural warranty?

How do you submit claims?

What are response times?

Are maintenance requirements needed to keep coverage valid?

Understanding warranty coverage is especially important when planning for Florida's weather-related risks. Read our guide on Florida home insurance to understand how insurance and warranties work together to protect your investment.

Inspections: Yes, You Still Need Them

Common mistake: Assuming "new" means "perfect." Even brand-new homes can have issues.

Order these inspections:

General home inspection near completion ($400–$600)

Pre-drywall inspection if possible ($300–$500)

Request copies of all county/city inspections

Inspections create your punch-list for the builder to address before or after closing under warranty.

How Long Does New Construction Take in Florida?

Timeline depends on whether you're buying inventory (already under construction) or building from scratch.

Typical ranges:

Inventory/spec homes:30–120 days

To-be-built homes:6–12+ months

What delays South Florida construction:

Permits and inspections in Broward and Miami-Dade cities

Storm season and heavy rainfall

Material and labor shortages

Ask your salesperson:

What stage is this home at today?

What's the realistic completion window?

What happens if the builder is delayed?

Build flexibility into your lease end date, especially for dirt-start builds.

Top Mistakes to Avoid

Assuming "new" means no inspection needed

Not budgeting for HOA + CDD fees

Over-upgrading at the design center

Not accounting for timeline delays

Believing incentive ads without seeing real numbers

Skipping the warranty booklet review

How to Negotiate With Builders

Builders negotiate differently than individual sellers. Try these tactics:

Financial Negotiations

Ask for higher closing cost credits

Request extra design center credits

Negotiate lot premiums

Clarify what's standard vs optional (appliances, blinds, pavers)

Timeline & Quality Protections

Ask about end-of-quarter inventory pushes

Request builder cover rate-lock extension fees if delayed

Ask if model home furniture is available for purchase

Come with a strong pre-approval, clear budget, and your "must-have" list. Your lender can help compare packages to find the best total cost.

Ready to Explore New Construction in South Florida?

Building a home is one of the biggest steps you'll take — our job is to make it simple, transparent, and stress-free from start to finish. We've guided hundreds of South Florida families through new construction, and we know exactly which questions to ask builders, which incentives actually matter, and how to protect your investment before you sign.

If you're considering new construction in Broward or Miami-Dade, start by seeing your real numbers and comparing communities.

Get pre-approved in minutes: Start your application

Explore Florida programs: See your options

Book a strategy call: Review builders and incentives

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender