Renting vs Buying in South Florida in 2026: A Lifestyle Comparison

In 2026, the best choice in Broward, Miami-Dade, and Palm Beach often comes down to lifestyle risk vs lifestyle freedom. Renting usually wins for flexibility and low responsibility. Buying often wins for stability and long-term control, but only when the home passes the Florida reality check (insurance, HOA, and maintenance).

If you're comparing South Florida rent vs buy in 2026 in Miramar, Pembroke Pines, Hollywood, Weston, or anywhere across South Florida, you're not alone.

Many buyers first try to compare options using a calculator, but the smarter approach is to consider how each choice fits your lifestyle, not just your monthly payment.

1) Flexibility vs stability

Renting fits best when:

You might move in the next 12–36 months (job change, family plans, relocation)

You want the freedom to upgrade neighborhoods without selling a home

You prefer predictable responsibility (call maintenance, not contractors)

Buying fits best when:

You plan to stay 3–5+ years

You want the option to customize your space (pets, renovations, outdoor living)

You're tired of rent increases and want a long-term home base

If you're curious how to buy with less than 20% down, check out You Don't Need 20% Down to Buy a Home in South Florida for strategies that work in today's market.

2) The "stress profile": what keeps you up at night?

In South Florida, the stress of housing usually shows up in different ways.

Renting stress usually looks like:

Annual rent increases

Not knowing if you'll be asked to renew or move

Limited control (rules, pets, renovations, parking)

Buying stress usually looks like:

Insurance volatility and escrow changes

HOA fees, special assessments, and condo rules

Maintenance and hurricane prep

For a detailed look at the hidden costs of ownership, see The True Cost of Owning a Home in South Florida in 2026.

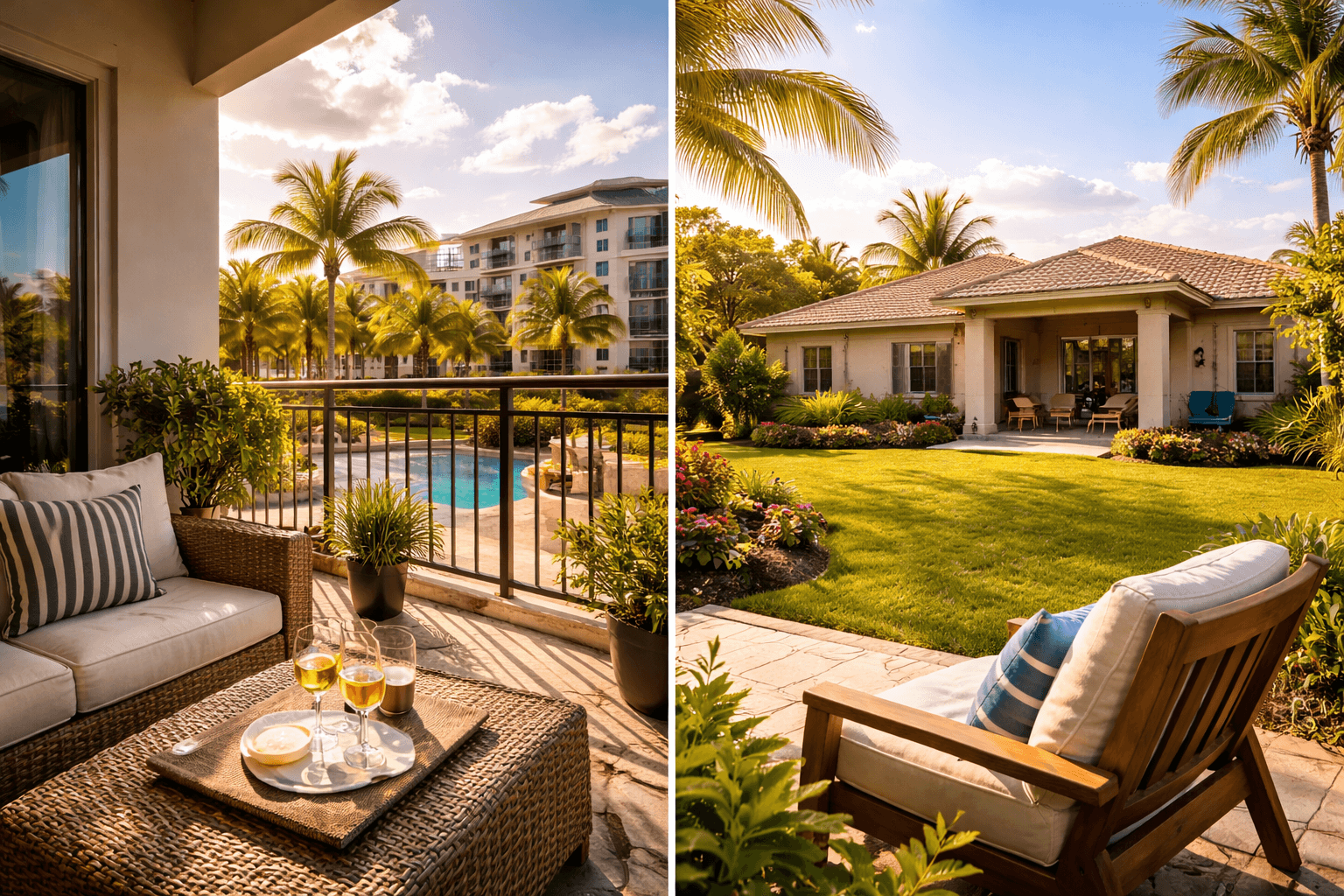

3) Your weekend lifestyle: what does "home" mean to you?

This is where the decision becomes personal.

Renting can be the better lifestyle choice if you value:

Walkability and amenities (especially in parts of Miami-Dade)

Being close to nightlife, dining, and social hubs

Low-commitment living while you explore neighborhoods

Buying can be the better lifestyle choice if you value:

A yard, storage, parking, and space for family life

A stable place to "set roots" and build routines

The ability to improve your home over time

Before you buy, it's smart to review HOA Fees in Florida: What's Reasonable and What's a Red Flag in 2026 to understand potential condo or HOA pitfalls.

4) Commute and daily routine (the hidden cost)

South Florida commutes are real. A "good deal" can feel expensive if it adds 45 minutes each way.

Before you decide, test your routine:

Drive your commute during real hours (I‑95, Turnpike, I‑75, I‑595)

Check parking and toll costs

Consider whether you need to be close to Miami job hubs or can stay more central in Broward

5) If you buy, pass the Florida reality check first

Buying works best when you choose the right property.

In 2026, we tell buyers to screen homes early for:

Insurability (roof age, wind protections, location)

HOA/condo health (reserves, assessments, rules)

Cash cushion (down payment + closing costs + reserves)

These guides help:

Learn why Florida home insurance is so high and how to navigate it

See how much cash you'll need with How Much Cash Do Florida Buyers Really Need in 2026

6) South Florida rent vs buy 2026: A simple decision framework

Choose rent (for now) if:

You're early in your career or expect a move

You don't want surprise costs

You're prioritizing lifestyle access over long-term stability

Choose buy if:

You want stability and plan to stay

You have a cash buffer after closing

You're willing to do the Florida reality check upfront

For competitive buyers, check out How to Compete With Investors and Cash Offers in South Florida to stay ahead in tight markets.

Bottom line

Renting can be the right move.

Buying can be the right move.

The win in 2026 is choosing the option that supports your daily life, your stress tolerance, and your future plans.

Ready to Make Your Move?

If you're deciding whether it's smarter to rent or buy in Broward, Miami-Dade, or Palm Beach, we can help you compare both paths with real numbers and real-life factors (insurance, HOA, cash to close, and monthly comfort):

Start your pre‑approval: Start your application now

Explore Florida homebuyer programs: You Don't Need 20% Down to Buy a Home in South Florida

Book a strategy call: Schedule a call

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender