The Most Common Homebuyer Regrets in Florida (2026) and How Smart Buyers Avoid Them

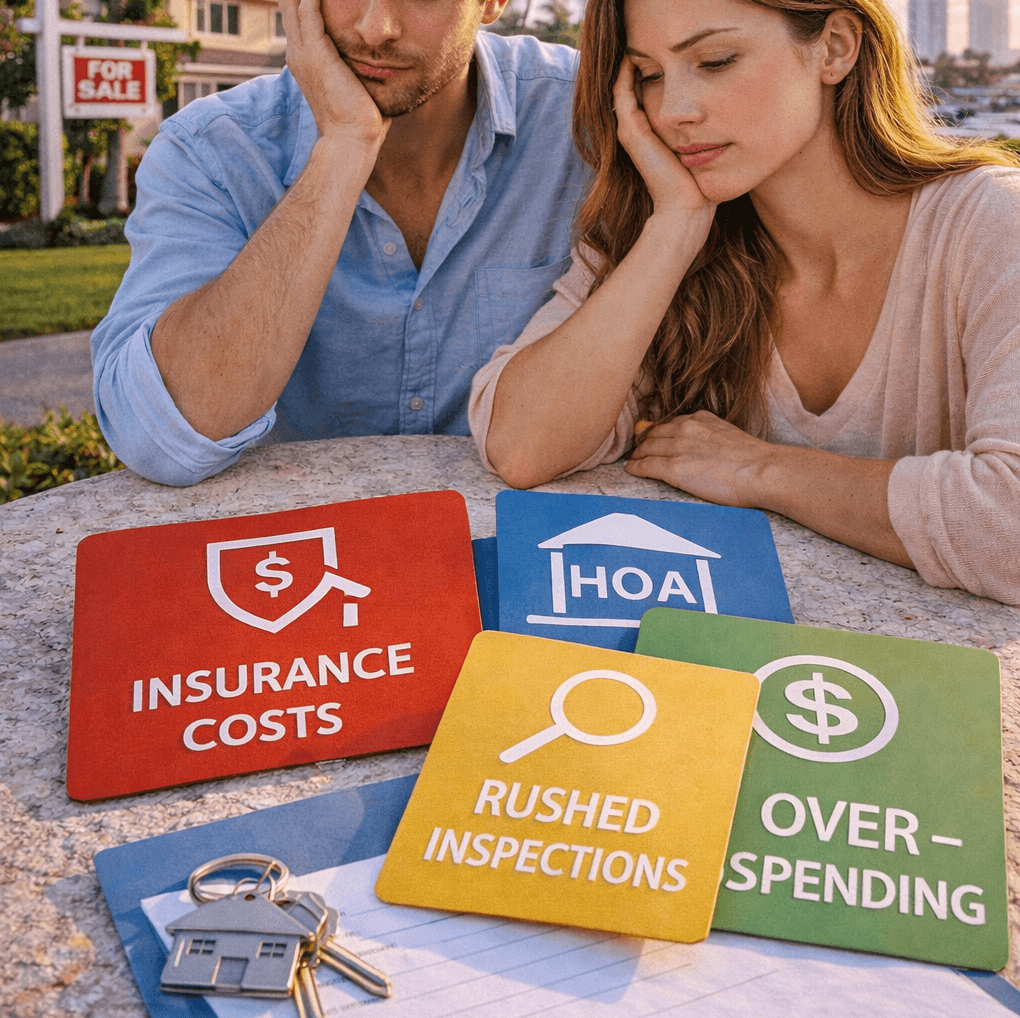

The biggest homebuyer regrets in Florida usually come from the same place: buyers fall in love with the home before they fully understand the real monthly payment and the real risks. In 2026, the most common regrets in South Florida (including Miami) are tied to insurance surprises, HOA/condo costs, rushed inspections, and stretching the budget too far. The good news is these regrets are avoidable with a clear checklist before you offer.

Most buyers don't regret buying a home; they regret the surprises that show up after closing.

If you are buying in Miami-Dade, Broward, or Palm Beach (including Miramar, Pembroke Pines, Hollywood, and Weston), use this as your "read before you write an offer" guide.

Regret #1: "I didn't realize insurance could change everything."

What happens: A home looks affordable on paper, then insurance quotes come in higher than expected. The monthly payment jumps. The deal gets stressful.

Why this happens: Insurance is often treated as a closing task instead of a buying decision.

This is especially common for buyers who don't realize why Florida home insurance is so high and how much underwriting has tightened in recent years.

How to avoid it:

Treat insurance as a shopping filter, not a last-week task.

Get quote scenarios early when you are serious about a property type or area.

Know whether the home may need a 4-point and/or wind mitigation inspection for coverage.

Regret #2: "We ignored HOA rules and fees until it was too late."

What happens: Buyers focus on the mortgage and forget that HOA dues can feel like a second payment. Condo buildings can also have special assessments or documentation issues that complicate financing.

Why this happens: HOA fees are listed as a single monthly number, but what they cover (and what they don't) is rarely clear until after an offer is accepted.

Many first-time buyers only look at the monthly HOA number without understanding what's reasonable and what's a red flag in Florida HOAs in 2026.

How to avoid it:

Ask what the HOA fee includes (insurance, reserves, amenities, maintenance).

Review rules, reserves, and any known assessments before you commit emotionally.

If you are buying a condo, remember you are underwriting the building, not just the unit.

Regret #3: "We waived or rushed the inspection because we were scared to lose."

What happens: Buyers skip protections to "win," then discover roof leaks, electrical issues, plumbing problems, or HVAC failures after closing.

Why this happens: Competition creates pressure to reduce contingencies, and many buyers confuse "competitive" with "reckless."

In 2026, smart buyers are more strategic about inspections and understand what Florida buyers can reasonably ask for during inspection negotiations without killing a deal.

How to avoid it:

Do not skip inspection just because a home looks clean.

Keep negotiations focused on major systems and safety, not cosmetics.

Use your inspection period to confirm condition and reduce insurance risk.

Regret #4: "We stretched our budget and now we feel trapped."

What happens: Buyers hit the payment ceiling, then normal life happens: renewals, escrow changes, HOA increases, repairs, and everything feels tight.

Why this happens: Lenders approve based on ratios, not comfort. "Qualified for" and "comfortable with" are not the same.

This regret is often tied to misunderstanding the full picture of ownership, not just the loan payment. Buyers who plan ahead usually review the true cost of owning a home in South Florida before choosing a price range.

How to avoid it:

Set a monthly "comfort ceiling" that includes mortgage + taxes + insurance + HOA.

Keep reserves for repairs and life events.

Choose stable affordability over "max approval."

Regret #5: "We budgeted using the seller's property tax bill."

What happens: After purchase, taxes can reassess. Escrows adjust. The payment rises and the buyer feels blindsided.

How to avoid it:

Ask for a realistic payment estimate tied to your expected purchase price.

Plan for escrow adjustments and future increases instead of assuming the current tax bill will stay the same.

Regret #6: "We underestimated cash-to-close."

What happens: Buyers plan only for down payment, then get surprised by closing costs, escrows, inspections, appraisal, and moving expenses.

Buyers are often shocked when they see how closing costs, escrows, and reserves add up beyond the down payment.

This is where many first-time buyers realize they didn't fully understand how much cash Florida buyers really need in 2026.

How to avoid it:

Request a cash-to-close estimate early (not after you are under contract).

Keep a buffer for inspection/appraisal and escrow setup.

Regret #7: "We didn't get fully pre-approved before shopping seriously."

What happens: Buyers fall in love with a home, then scramble. Timelines tighten. Sellers choose an offer that feels "cleaner."

Many of these situations could be avoided by following a proper pre-approval checklist before shopping, rather than relying on a quick pre-qualification.

How to avoid it:

Get a strong pre-approval before touring aggressively.

Keep finances stable while shopping (no new debts, no big purchases, no job changes).

Who this guide is for

First-time Florida buyers

Condo buyers in Miami & South Florida

Buyers approved at the top of their budget

Anyone worried about insurance or HOA surprises

Final takeaway

Most Florida homebuyer regrets are not about choosing the "wrong house." They are about choosing the right house without the right plan. In 2026, the smoothest closings come from buyers who treat insurance, HOA risk, inspections, and cash-to-close as part of the decision before they write the offer.

Want to avoid these regrets before you offer?

Get fully pre-approved (not just pre-qualified): Start your application and know your real numbers before touring

See what programs actually fit your situation: Explore low-down-payment and first-time buyer options

Build a buying plan, not just a payment: Schedule a strategy call to review insurance, HOA risk, and cash-to-close upfront

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender