The True Cost of Homeownership in South Florida (2025 Edition)

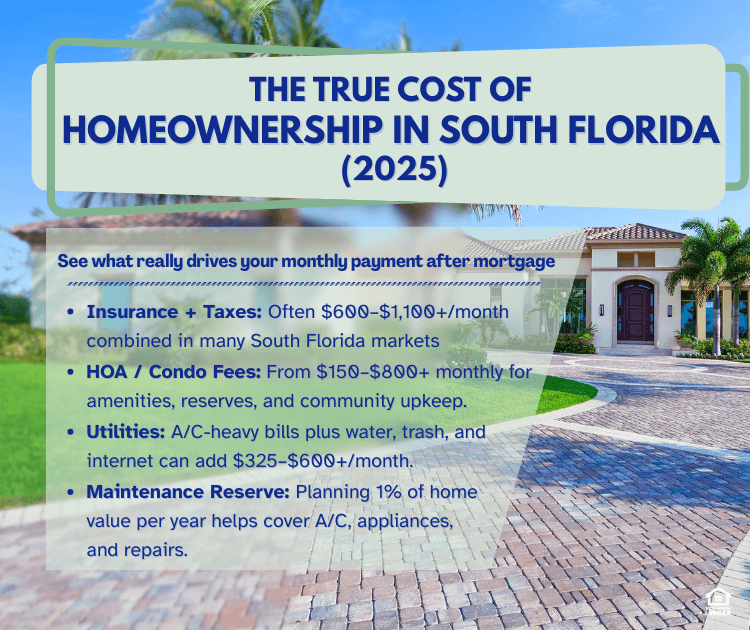

In South Florida, the mortgage is only part of the story. Once you add insurance, HOA fees, utilities, property taxes, and maintenance, many buyers see $800–$1,500+ per month on top of principal and interest depending on the home and community.

When buyers tell us, "My mortgage estimate looks fine, but I'm still nervous about the monthly payment," this is exactly what they're sensing: the non-mortgage costs that come with owning in Broward, Miami-Dade, Palm Beach, and the rest of Florida.

South Florida has higher variable costs than most states, so accurate budgeting matters more here than almost anywhere else in the country.

As a South Florida mortgage broker, we walk clients in Miramar, Pembroke Pines, Hollywood, Weston, Orlando, Tampa, and Jacksonville through these numbers before they fall in love with a listing. Your budget needs to include insurance, HOA fees, utilities, taxes, and maintenance, not just the loan.

For more context, it also helps to read our guides on property taxes in South Florida and how much cash you really need to buy a home in Florida on our site.

Why This Matters

Many first-time buyers qualify on paper, but the ongoing monthly costs determine long-term comfort. A realistic all-in number leads to fewer surprises and a smoother first year of ownership.

Insurance: $3,000–$6,000+ Per Year

In many parts of South Florida, homeowners insurance can rival your property taxes:

Typical range: $3,000–$6,000+ per year on a standard single-family home

Coastal or older homes in Miami-Dade or eastern Broward can run higher

Adding flood insurance or a wind pool policy increases costs again

A 3-bedroom home in Miramar might see $3,500–$4,500/year in premiums. A similar-age home closer to the coast in Hollywood or Miami could easily reach $5,000–$7,000/year, especially with an older roof.

Reality check: Insurance can increase after a reassessment year, so plan with a buffer.

HOA and Condo Fees: $150–$600+ Per Month

HOA and condo fees are common in South Florida:

Townhome in Miramar or Pembroke Pines: often $150–$350/month

Gated single-family community in Weston or Plantation: $200–$400/month

Mid- or high-rise condo in Downtown Miami or Brickell: $400–$800+/month

These fees can include lawn care, security, pools, gyms, cable, and reserves for big-ticket repairs, but they still hit your monthly budget like another mini-loan payment.

Utilities: A/C, Water, and Everything In Between

In our climate, air conditioning is a big deal:

Electric (including heavy A/C use): $175–$300+/month for many single-family homes

Water/sewer/trash: $60–$150+/month, depending on city and usage

Internet and streaming: $75–$150/month

A newer, energy-efficient home in Doral, Parkland, or a recent Miramar community may land near the lower end. An older block home in Hollywood, Hialeah, or Lake Worth with original windows could land higher.

Property Taxes: 1%–1.5% of Purchase Price Per Year

Many South Florida buyers underestimate how much property taxes add:

A common planning range is about 1%–1.5% of the purchase price per year

A $450,000 home may see $4,500–$6,500/year in taxes once reassessed

Remember that when you buy, the county can reset the assessed value closer to your purchase price, not the seller's old, lower number. For primary residences, the Florida Homestead Exemption and Save Our Homes cap help in future years, but not on day one.

Maintenance Reserves: The Hidden but Necessary Line Item

Even in a townhome or condo, you'll still want to set aside something each month for A/C repairs, appliances, paint, and minor updates.

A simple rule of thumb is 1% of the home's value per year in long-term maintenance. On a $400,000 home, that's about $4,000/year or $330/month set aside in savings.

Reality check: In South Florida's climate, HVAC systems age faster because they run almost year-round.

Your Monthly Payment Includes More Than You Think: Full Cost Breakdown

Pulling It Together: Realistic Monthly "All-In" Examples

Example 1: Townhome in Miramar (Broward County)

Insurance: $315/month

HOA: $250/month

Utilities: $250/month

Taxes: $415/month

Maintenance reserve: $250/month

Estimated non-mortgage total: $1,480/month

Example 2: Single-Family Home in Miami-Dade (Closer to Coast)

Insurance: $460/month

HOA: $150/month

Utilities: $275/month

Taxes: $585/month

Maintenance reserve: $325/month

Estimated non-mortgage total: $1,795/month

When we build your budget as a South Florida mortgage broker, we always look at this "all-in" number, not just the rate and principal.

Frequently Asked Questions

What is the average monthly cost of owning a home in South Florida?

Beyond your mortgage payment, expect to add $800–$1,500+ per month for insurance, HOA fees, utilities, property taxes, and maintenance reserves. The exact amount depends on the home's location, age, and community type.

Why is homeowners insurance so expensive in Florida?

Florida's hurricane risk, coastal exposure, and aging housing stock drive up insurance premiums. Homes with older roofs (15+ years) or in flood zones face even higher costs. Many buyers also need separate flood and wind policies.

How can first-time buyers lower their monthly costs in Florida?

Consider inland communities like Miramar or Pembroke Pines over coastal areas, look for newer homes with energy-efficient features, choose properties with lower HOA fees, and apply for the Florida Homestead Exemption immediately after closing to cap future tax increases.

If you're thinking about buying or refinancing in South Florida, reach out today to explore your best options:

Get pre-approved in minutes: Start your application now

Explore Florida homebuyer programs: Learn about FHA, low-down, and first-time buyer options

Book a strategy call: Schedule a call to review your full monthly budget

EZ Funding Group, Inc. NMLS #349022 | Jaime Charouf NMLS #348964 | Equal Housing Lender